Financial Literacy: A Catalyst for Economic Progress

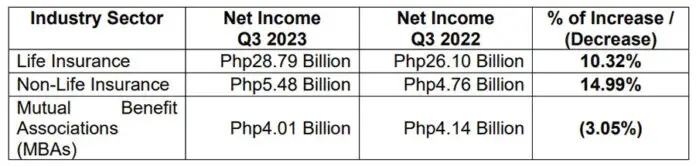

The recent data released by the Insurance Commission reveals a stagnation in the Philippines’ insurance penetration, a vital economic indicator. As of the end of September 2023, insurance penetration slightly declined to 1.68 percent from 1.81 percent the previous year, despite the digitalization that has simplified access to insurance products. This measure indicates the insurance sector’s contribution to the gross domestic product and underscores the broader implications of financial literacy on national economic health.

The Role of Education in Insurance Adoption

Sun Life of Canada Philippines, a leading insurance provider, is at the forefront of efforts to enhance the country’s insurance penetration through robust financial literacy programs. Benedict Sison, CEO and country head, emphasizes the significant gap between awareness and action. He notes that enhancing financial literacy is essential for individuals to recognize the importance of insurance policies in their financial planning. Sison explains that financial education is not an instantaneous process but requires ongoing engagement and a willingness to learn more about managing personal finances effectively.

The Need for More Financial Advisors

The challenge of low insurance penetration is compounded by the limited number of financial advisors relative to the population. With fewer than 500,000 advisors for over 115 million Filipinos, there is a critical need for more professionals in the industry to guide potential clients through the complexities of financial products. Sison advocates for increasing the workforce dedicated to financial advising as a means of nation-building and economic advancement. He argues that a more financially literate populace is crucial for the country’s progress and that the industry must collaborate to achieve significant improvements in insurance penetration rates.

Enhancing National Financial Health Through Education

The effort to boost financial literacy and, consequently, insurance penetration in the Philippines is a long-term endeavor that requires collective action from all industry players. While Sun Life commands a substantial share of the market, Sison stresses that a single company’s efforts are insufficient to effect widespread change. The goal is to outpace population growth with enhanced financial education and advisory services, ensuring that more Filipinos understand and utilize financial products effectively. This strategic focus not only aims to improve individual financial stability but also to foster overall economic resilience and growth.