The Necessity of Financial Literacy and Career Guidance at Mount Carmel

Mount Carmel has long been a beacon for transforming boys into men, ready to face the world. Yet, the journey from adolescence to adulthood at Mount Carmel could be further enriched by integrating comprehensive financial education and career planning into the curriculum. This enhancement would ensure students not only face college and their future careers with resilience but are also equipped with the financial acumen needed to navigate the complexities of modern economic life.

Bridging the Gap in Financial Competence

Despite the emphasis on academic rigor, there remains a significant gap in practical financial literacy among students. A 2022 survey by U.S. News revealed that only about half of college students felt prepared to manage their finances. By incorporating targeted financial education programs, such as practical experiences in investing or managing a startup within a classroom setting, Mount Carmel can significantly improve financial literacy. This hands-on approach, suggested by Mr. Scott Tabernacki, aims to solidify financial concepts, ensuring students leave with a robust understanding of personal finance.

Career Exploration and Life Skills Development

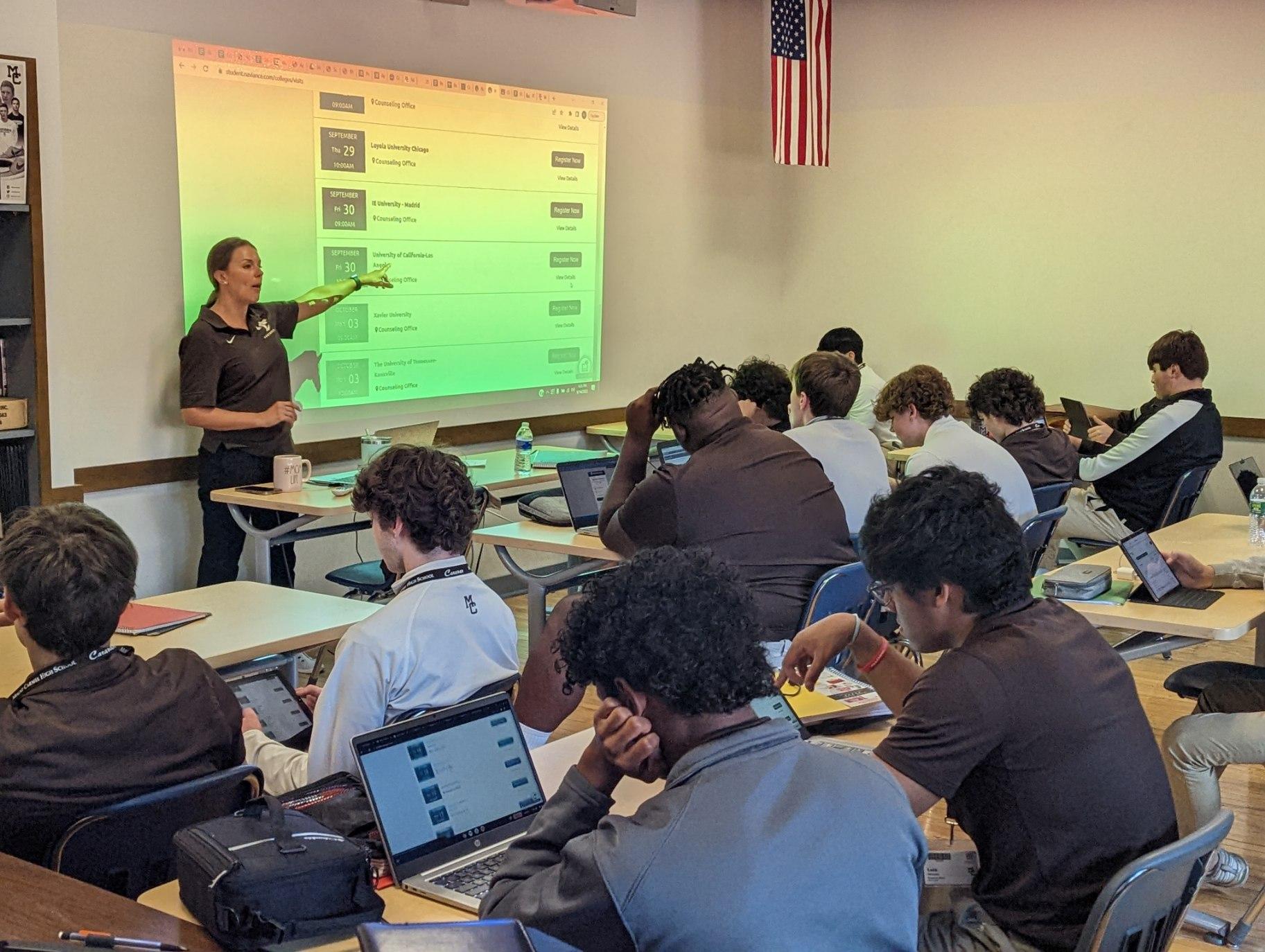

Furthermore, career exploration is another critical area that requires enhancement. Mrs. Kristina Luster, Dean of Student Services, advocates for programs like YouScience, which align careers with students’ interests and personalities, helping them make informed decisions about their future paths without the costly process of changing majors multiple times in college. Additionally, there’s a growing recognition of the need for basic life skills training—ranging from cooking to vehicle maintenance—that are essential for independent living. By establishing a curriculum that includes life skills alongside academic and financial education, Mount Carmel can better prepare students for the realities of adult life, making them more competent and confident individuals.