The Importance of Financial Literacy for Students

Credit scores, interest rates, and taxes are crucial aspects of financial literacy. However, nine out of ten students in Massachusetts are not required to learn about these important topics. Should the state mandate financial literacy education for all students?

Sean Simonini, reflecting on his middle and high school years, realized he never received essential financial education. “We talk about the ‘birds and the bees,’ which is an uncomfortable topic, but people are even more uneasy discussing credit cards with their kids!” Simonini remarked. He noted that schools also avoid teaching about money, leaving students unprepared for real-world financial responsibilities.

The Push for Financial Education in Massachusetts

Simonini, who excelled academically at Billerica High and earned a full scholarship to the University of Massachusetts-Lowell, found himself lacking basic financial knowledge. “I couldn’t tell you anything about my taxes, credit scores, or 401(k) plans,” he admitted. As a college sophomore, he began advocating for a standalone financial literacy class to be a requirement for every student in Massachusetts.

In his role as a student representative on his town’s school board, Simonini started pushing for a bill to make financial literacy education mandatory in every district. The proposed classes and teacher training would be funded by the state through a “financial literacy trust fund.” “I envisioned an education system where every student graduates with the necessary skills to succeed, and one glaring gap was financial literacy in the Commonwealth,” he said.

Current State and the Need for Change

Currently, 25 states have made financial literacy a graduation requirement, but Massachusetts is not one of them. Neighboring states like New Hampshire, Connecticut, and Rhode Island have mandated such courses. Champlain College in Vermont annually grades states on their financial literacy efforts, with 29 states receiving an ‘A’ or ‘B’, while Massachusetts earned an ‘F’.

Out of over 300 school districts in Massachusetts, only 16 require students to pass a personal finance class. Simonini believes this lack of education sets kids up for a lifetime of debt without understanding the consequences. “We allow 18-year-olds to take on massive loans without any orientation to the long-term financial impacts,” he emphasized.

Advocates for Financial Literacy

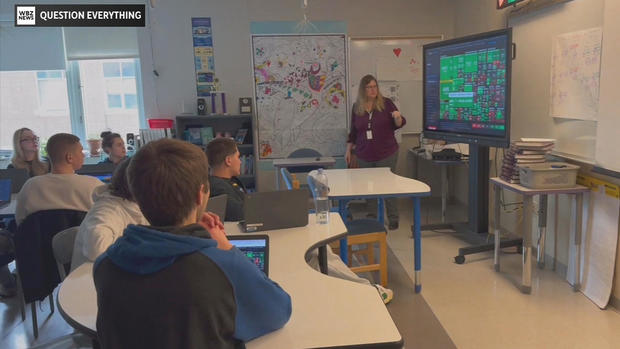

Sue Camparato, a teacher in Swampscott, one of the few districts requiring a personal finance class, believes Massachusetts is lagging behind. Camparato teaches her students about credit scores, interest rates, stocks, saving money, and filing taxes. “No student ever asks, ‘When will I use this?’ because they see its immediate relevance,” she said.

Her student, Sam Snitkovsky, stressed the importance of this education, especially as young people are often targeted by financial misinformation on platforms like TikTok. “This information comes from a trusted teacher, not some anonymous online user,” Sam pointed out.

Efforts and Future Goals

State Treasurer Deb Goldberg, who leads the Office of Financial Empowerment, supports mandatory financial literacy courses. Her office provides free financial programs for all ages, emphasizing the knowledge gaps revealed during events like the Credit for Life fairs for high school students. Goldberg believes a public-private partnership could fund these programs across all districts.

Simonini and Goldberg are hopeful that lawmakers will recognize the importance of financial education and make it a priority. They argue that Massachusetts cannot afford to receive an ‘F’ on its next financial literacy report card. For the sake of future generations, it’s essential to ensure every student graduates with the financial knowledge needed to navigate their economic futures successfully.