Creative Solution to Engage Students

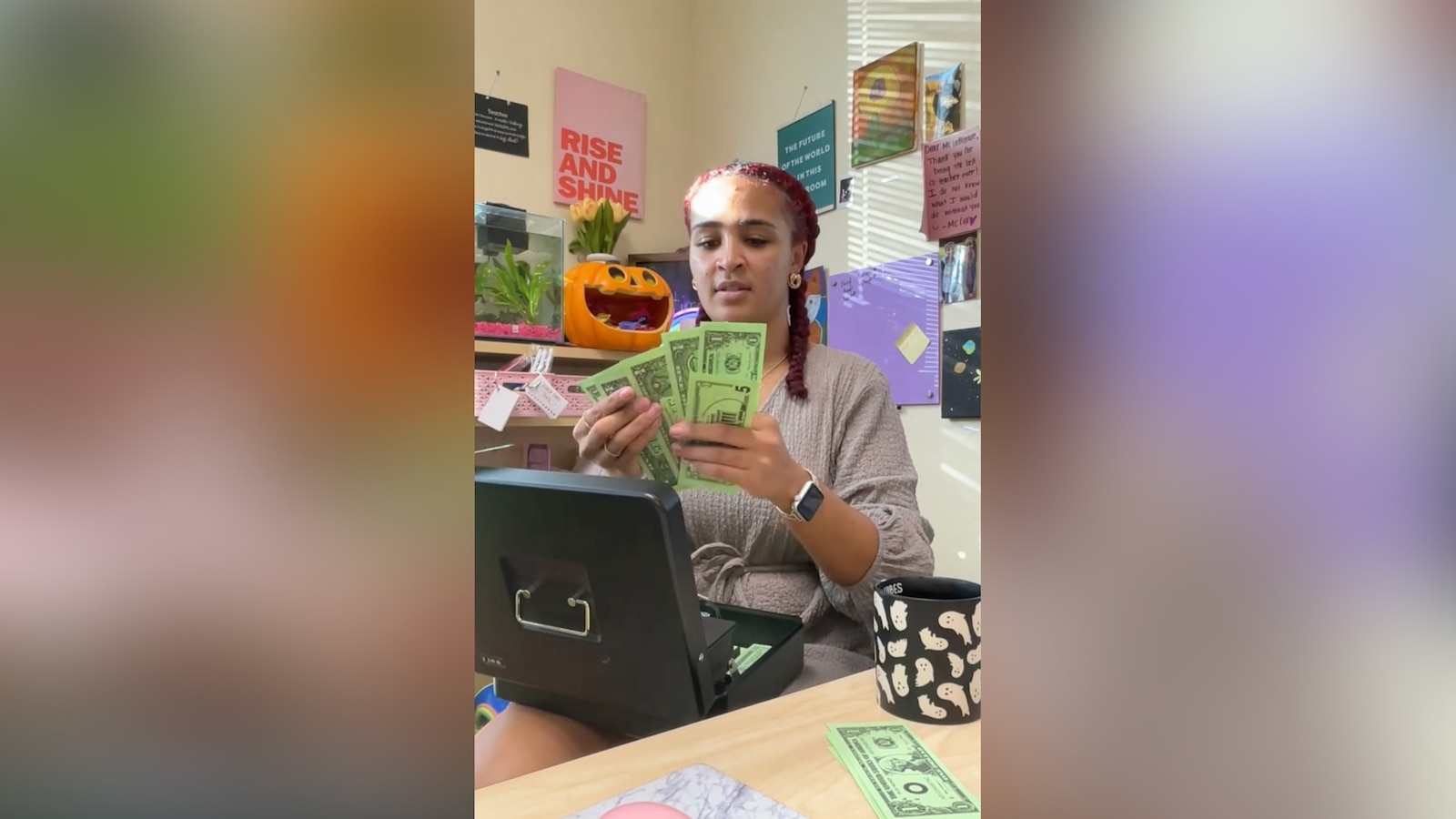

When Shelby Lattimore noticed her students weren’t attending class regularly, she devised a unique and engaging way to encourage attendance and enthusiasm for learning. Lattimore, a math and science teacher at a Title 1 school in Charlotte, North Carolina, created a “class economy” where students are assigned jobs, receive “paychecks,” and are charged “rent” or “fines.” This system has been highly effective, with her third graders now fully invested in their class economy.

Implementing the Class Economy

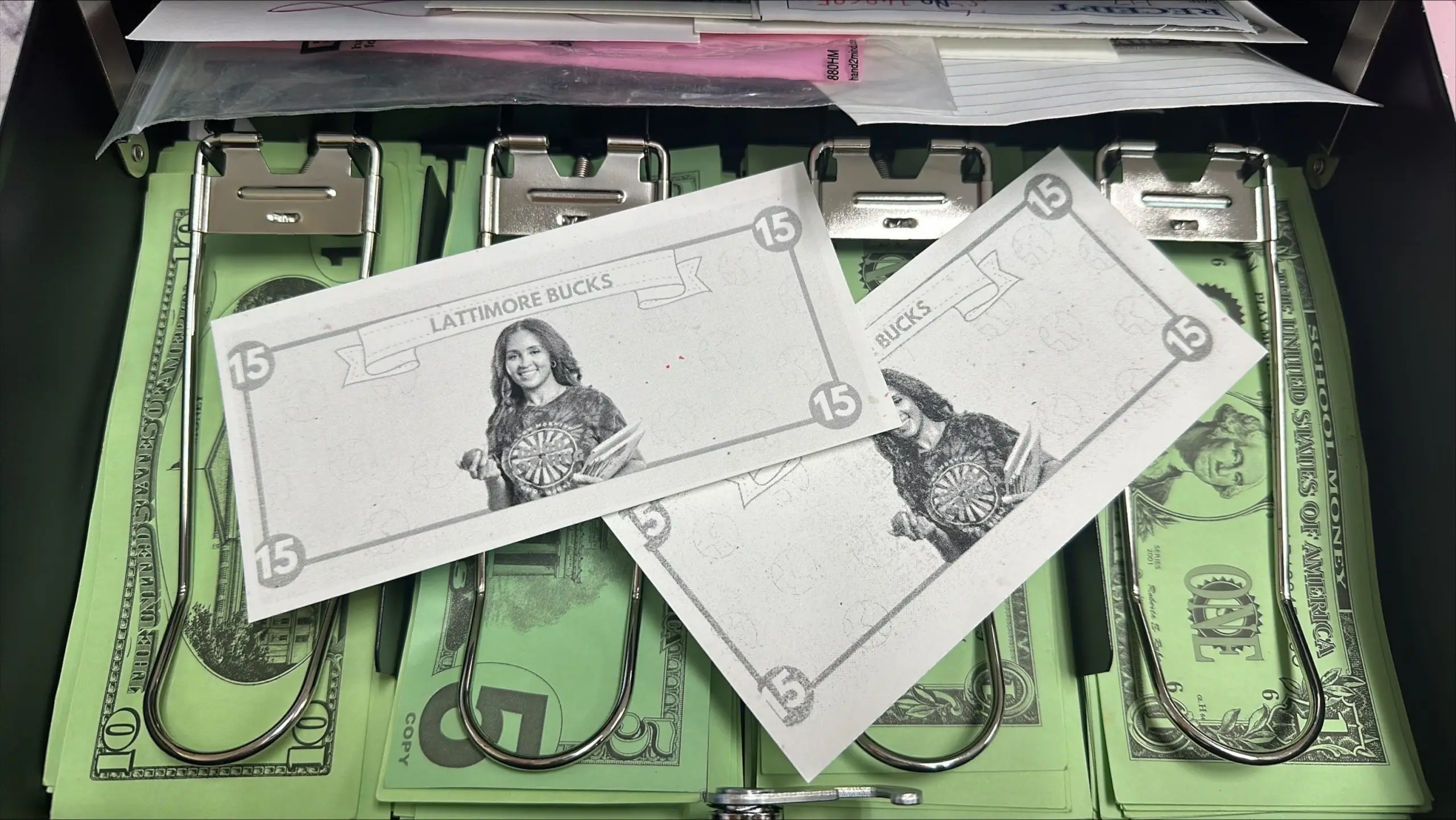

Since the fall of 2022, Lattimore has been refining this program based on her own experiences and student feedback. She developed this system not because she saw it elsewhere but because it mirrored her own adult responsibilities. Using play money, including “Lattimore Bucks,” her students earn and spend as they learn about financial literacy through real-world simulations.

Jobs, Bills, and Rewards

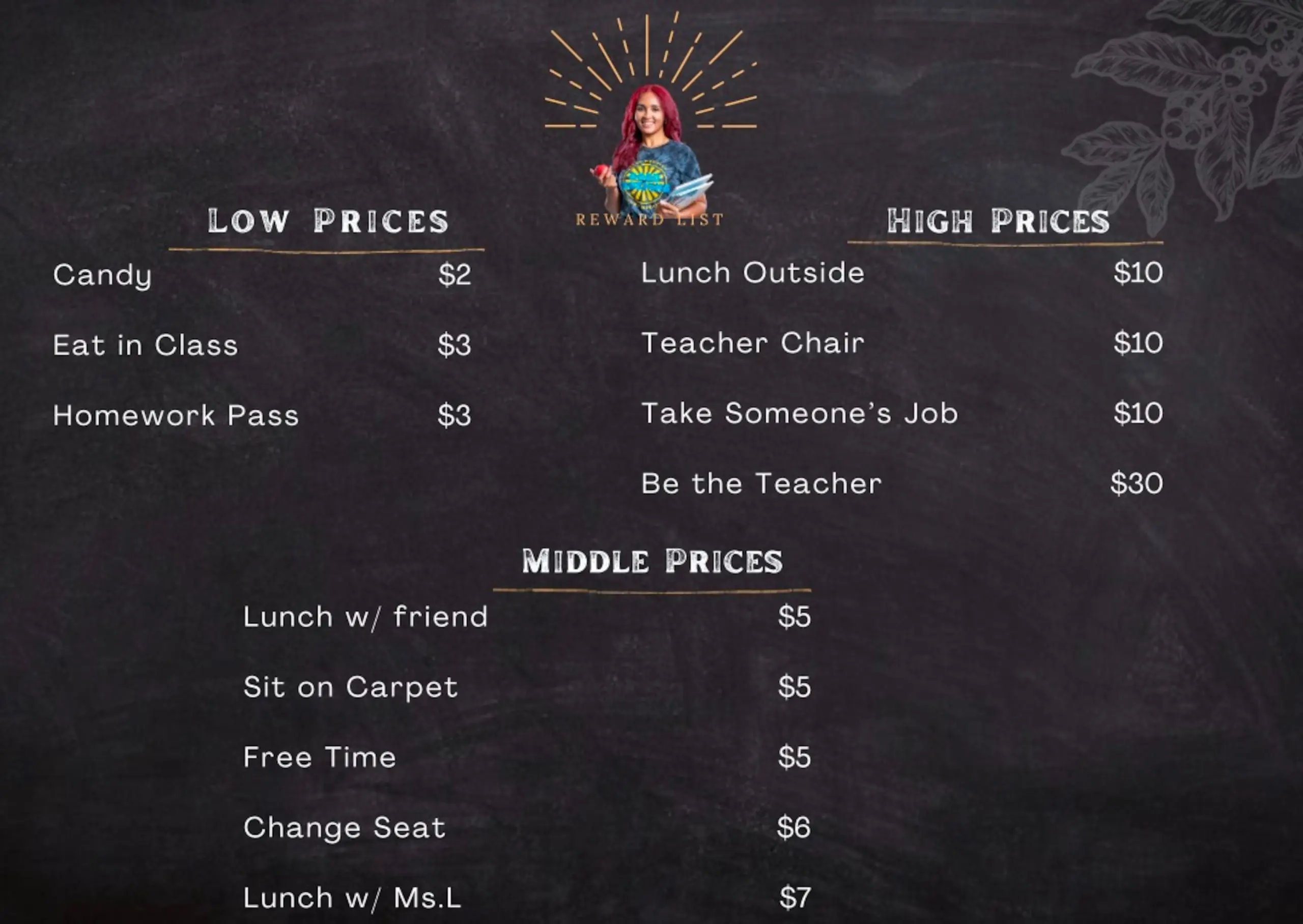

In Lattimore’s class, there are three main components: jobs, bills, and rewards. Students can choose from roles like door holder or class pet helper, earning paychecks every two weeks based on their job. They also pay monthly “rent” for their desks and chairs, with Lattimore introducing inflation adjustments to mimic real-life economic changes. Rewards range from simple treats to more significant perks like being the teacher for a day, teaching students to budget and save.

Real-World Skills and Future Impact

Lattimore’s innovative approach has not only improved attendance but has also taught her students essential financial skills such as budgeting, saving, and understanding receipts. Observing the class economy in action, Lattimore ensures it runs smoothly while her students take charge. She plans to create a manual for other educators and parents, emphasizing the importance of starting slow and ensuring students grasp each concept before moving on.

Long-Term Benefits and Generational Change

Lattimore’s students have embraced this learning experience, and she sees its potential to impact their futures significantly. She wishes she had received similar education growing up, noting that financial literacy is a skill she continues to learn as an adult. The feedback from parents, especially those affected by generational poverty, has been overwhelmingly positive, highlighting the program’s potential to change family dynamics and create lasting financial stability for future generations.