Pioneering Financial Education at Bowman High School

Junior Chamber International (JCI) of Santa Clarita, in collaboration with the William S. Hart Union High School District, successfully hosted its “Get True: Adulting 101” event at Bowman High School. This initiative marked a significant stride in the ongoing quest to foster gender equality and provide practical financial education. During this event, nearly 200 students engaged in an economic simulation designed to mirror real-life financial decision-making, illustrating the importance of financial literacy in today’s challenging economic landscape.

Engaging Students in Realistic Financial Scenarios

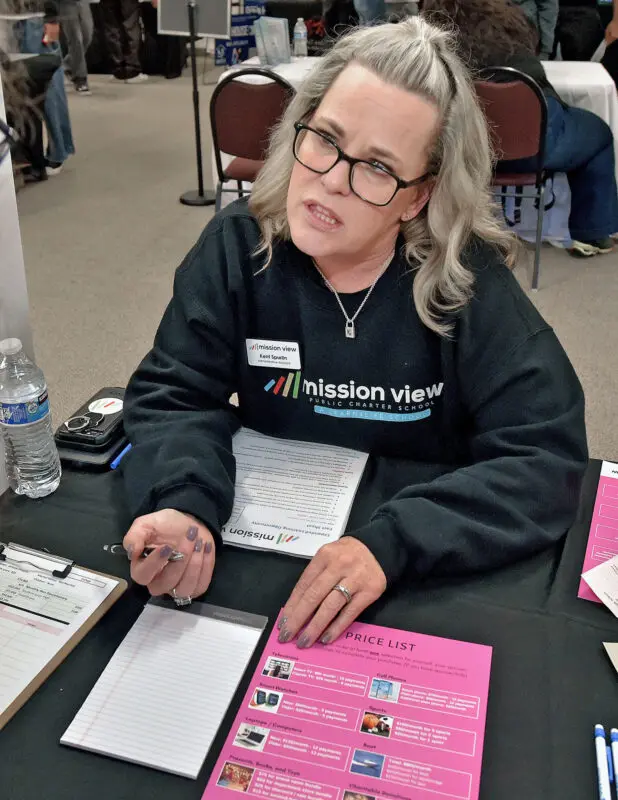

The program, which took place from 9 a.m. to 4 p.m., involved students stepping into the shoes of adults with assigned identities complete with occupations, incomes, credit scores, and family statuses. Pam Thompson, a work experience consultant at Bowman, detailed how students interacted with stations manned by real-life experts in various fields, including housing, utilities, and financial planning. This hands-on approach allowed students to make budgetary decisions and face unexpected financial dilemmas, such as dealing with a flat tire or unexpected bills, mirroring the unpredictability of real-world financial management.

Reflections and Insights from Participants

The event not only educated students on the mechanics of budgeting and financial planning but also highlighted the impact of credit scores on purchasing power and the importance of making informed financial decisions. Students like Mia Blanco and Isabela Alvarado expressed newfound appreciation for budgeting and the significance of credit scores in financial health. The practical lessons learned about property investment, the advantages of owning versus renting, and the principles of compound interest were particularly eye-opening for many students, demonstrating the tangible benefits of early financial education.

This innovative program by JCI at Bowman High School serves as a model for how immersive financial education can equip young people with the tools they need to navigate the complexities of personal finance confidently and make informed decisions that align with their long-term goals and lifestyles.