Market Uncertainty Amid Economic Shifts

Two years prior, a consensus among market analysts suggested impending turmoil due to the conclusion of historically low interest rates, shaking the stability of numerous asset classes. As bond prices climbed and cryptocurrencies faltered, skeptics on Wall Street loudly voiced concerns, arguing that the prolonged period of inexpensive capital was a fleeting anomaly. The market’s mood was oscillating dramatically—from optimism to skepticism, from adventurous investments to conservative savings strategies.

Resilience and Record Highs in Global Markets

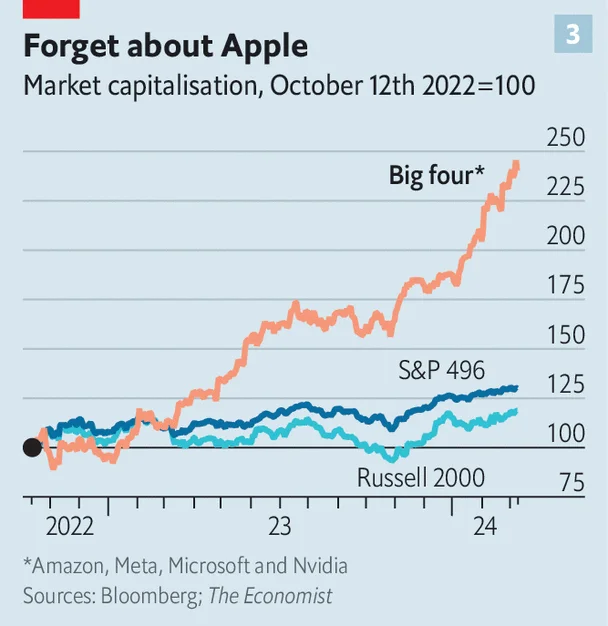

Despite predictions of doom, markets in the UK reached their nadir in October 2022 but swiftly rebounded, achieving record highs globally in less than a year and a half. For instance, the S&P 500 demonstrated robust growth, advancing in the majority of the months that followed. Nvidia, a titan in the AI hardware arena, saw its market valuation skyrocket by over a trillion dollars. This rally in both equity and crypto markets occurred despite central banks’ aggressive interest rate hikes, reigniting debates about the potential formation of a market bubble.

Echoes of the Past and Present Market Trends

This current market enthusiasm is reminiscent of the late 1990s’ dot-com boom, where optimism about the internet’s potential to enhance productivity led to inflated valuations. While the internet did transform business practices, early investors in tech giants faced substantial losses. The tale of Cisco during that era highlights a classic bubble characteristic: investments driven by speculative rather than fundamental values, relying on the hope of selling assets at a higher price, irrespective of their intrinsic worth. This cycle continues until the speculative support withdraws, often resulting in a sharp downturn.

Market Analysis: Sustainable Growth or Speculative Excess?

Today’s focus is on AI, with significant investments pouring into major tech firms, pushing their valuations to notable heights. Although these valuations are high—around 25 times future earnings—they have not reached the extreme levels of the dot-com era. The current market behavior suggests a cautious optimism, with investors showing confidence but not to the extreme levels seen in previous bubbles, according to recent surveys from financial institutions like Bank of America. This indicates a more measured and possibly sustainable market enthusiasm.

Future Market Directions: Indicators of Stability or Volatility?

The broader distribution of market gains beyond the leading tech behemoths will be a critical indicator of the market’s true temperature. A rise in IPOs and increased investments in smaller or riskier businesses could signal either a maturing optimism or the onset of speculative fervor. Observing these developments will be essential for predicting whether the market is gearing up for continued growth or bracing for a potential setback. The balance between innovation-driven growth and speculative investment will dictate the next phase of the bull market’s trajectory.