The US market’s extraordinary annualized growth rate of 5.2% in the second quarter of this year may have been reported in sober and accurate ways by the Financial Times. Let me provide a detailed account of what transpired in November. Forget about quick progress or soft flights; instead, the US economy shrank at a rate of about 30% annually in that quarter alone. President Joe Biden may be bread for it because it represents the end of the American dream.

Don’t worry. I have never lost my pebbles. The estimate above is correct, but it is not good. After converting US GDP using industry exchange rates, I calculated the US monetary performance in November, which I assumed did not contribute significantly. Therefore, I annualized the effect. The effect was driven by the nearly 3-percent decline in the value of the US dollar during the month.

You would be correct to assume that this is an immoral comparison of the economy, but it is incredibly popular among those who ought to be more educated. Take former Bank of England governor Mark Carney as an example, who claimed that the UK market was 90% as big as the German market before the Brexit referendum but had fallen to 70% by the end of 2022. The relative reduction in gold caused that shift.

Consider the German Council on Foreign Relations’ claim that the EU’s business was third-larger than the US in 2008 and that the US was then third-larger? Simply put, that was a surge in the US dollars from a small base.

You are viewing an illustration of an interactive visual. This is most probably due to being online or having JavaScript disabled in your website.

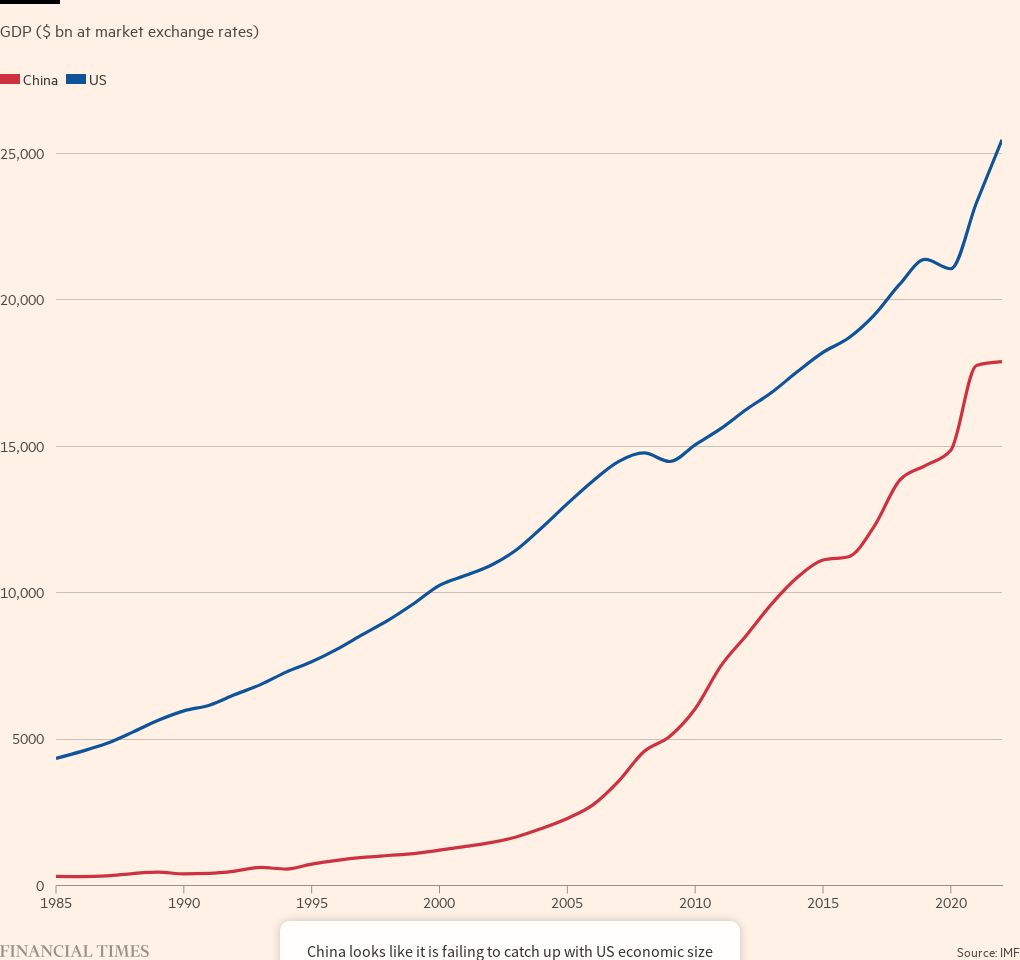

The list goes on. Numerous news organizations have reported that Japan will fall behind Germany in the rankings for the nation’s third-largest market this month based on these ridiculous market exchange rate comparisons. And, obviously, the US is also the world’s largest economy with China’s market failing to catch up.

Private data and international data must be used in order for international comparisons to be based on a fundamental requirement. This is why the profession of economics created purchasing power parity exchange rates, which allowed (impartial) comparisons to be drawn based on the goods and services that money can purchase. This affects both the size of the economy and military might. Consider, China funds the People’s Liberation Army using yen. It doesn’t come from the US.

According to the most recent IMF data, China’s GDP was higher than that of the US when Donald Trump was “making America great again” (PPP). It is now 22 percent larger. When you examine supporting facts, the images make sense. China’s energy technology, for example, overtook that in the US in 2010. And during the 2016-22 interval when China’s economy was presumably making no progress compared with the US, its creation grew 45 percent, while it was widely level in America.

It comforts both the US and China by failing to acknowledge the reshape of the world’s financial strength. I may know United for because I come from the UK, which lost its top economic puppy status in the late 19th century but also harbors some delusions of grandeur. If China can still sustain its fish position, it is also easier to prevent responsibilities for international goods like climate change, bill relief, and other global issues. In Europe, it is suitable for those who want financial reforms to draw attention to a sense of stagnation because it makes change appear more serious.

But unfortunately, poor comparisons develop bad decisions. At business exchange rates, it would be simple for the EU economy to once again surpass that of the rest of the world. The European Central Bank would only need to raise interest rates to hit the necessary level for the euro. That might briefly improve Europe before it realized it was going through the worst recession of all time.