Associated Black Charities (ABC), a Baltimore-based racial equity organization, will hold its first Teen Financial Literacy Summit on April 13 at the DoubleTree Baltimore North Hotel in Pikesville, Md. The free event builds on the six-week Teen Financial Literacy summer set on ABC that ran past summer.

Baltimore-area children aged 12 to 16 are welcomed to enter the mountain, alongside a caretaker aged 18 and over, to learn about important subjects, including entrepreneurs, budgeting, assets, liabilities, debt management, investing, and philanthropy.

“As Black individuals, we’ve been disenfranchised from information on how to create money, how to have multiple streams of income, and how to become traders,” said Chrissy Thornton, president and CEO of ABC. “As we are instructing the next generation, we need to make sure that the present generation is prepared to support their children in the same way that the previous century has the details.”

Nick Mosby, leader of the Baltimore City Council, will deliver the summit’s opening address. The visitors will then take part in breakout sessions on financial essentials. During one period, guardians and junior may individual. Teenagers may participate in a conversation about overcoming millennial prejudices regarding wealth, while youngsters will learn about job searching and interviewing techniques.

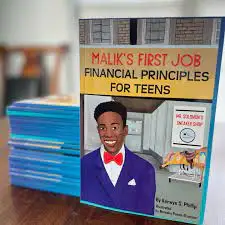

The system employs syllabus from Morgan State University student Kerwyn Phillip’s publication, “Malik’s First Job”. Malik has his primary job interview at a neighborhood glove shop, according to the story. During his career trip, he seeks his family’s guidance to learn how to manage cash and be financially responsible.

Phillip claimed that his desire to prevent young persons from facing the same economic difficulties that he did.

“Coming out of college, I didn’t know how to properly manage money.” A lot of the things that I’m teaching now, I didn’t do myself,” said Phillip. “It caused me to get into debts and to struggle financially. I merely wanted to share what I’ve learned so that the next generation doesn’t go through what I did.

Without a thorough understanding of finances, Phillip claimed that people are unable to go on intergenerational wealth to their children. He cited a study from The Williams Group, which found that 70% of wealthy people are left without money by the second century.

“We’re hoping that with this system, we help fire talk within homes,” said Phillip. “These kids are still in their teenage years. We hope that by the time they are older, they will already be able to comprehend and appreciate funding.