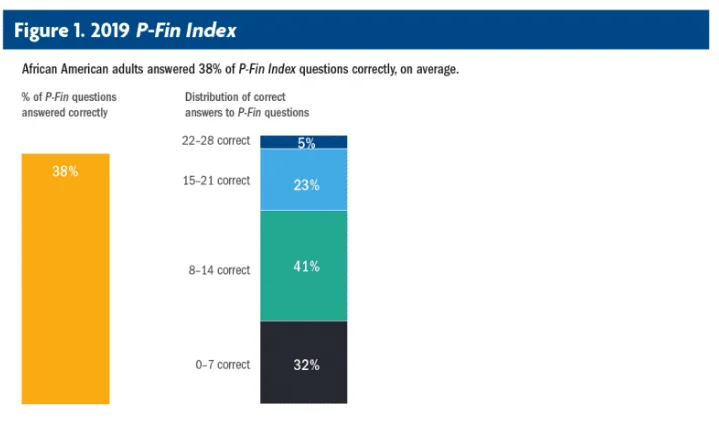

Financial literacy is alarmingly low among many U.S. adults. Despite the considerable economic influence of African Americans, their overall financial well-being often trails behind the national average. According to the P-Fin Index, an annual survey by the TIAA Institute and the Global Financial Literacy Excellence Center, African American adults answered only 37% of the questions correctly, with a mere 5% scoring over 75%.

The Importance of Financial Literacy

Rebecca Lomax, an associate relationship manager at KeyBank, highlights the significance of financial literacy. She works with a team to create and implement comprehensive wealth strategies tailored to clients’ needs. KeyBank’s African Heritage Key Business Impact and Networking Group (AHKBING) is dedicated to fostering an inclusive workplace and promoting financial education among Black employees.

Lomax’s interest in financial literacy began when a friend helped her understand the terms of her first car loan. This experience sparked her fascination with credit and financial management. She has since built a career in banking, helping clients improve their financial health through effective credit and lending strategies.

Rebecca Lomax speaks at Cummins, Inc. about KeyBank and AHKBING for Indy Black Professionals networking event on Oct. 12, 2023. (Photo provided/Rebecca Lomax)

Rebecca Lomax speaks at Cummins, Inc. about KeyBank and AHKBING for Indy Black Professionals networking event on Oct. 12, 2023. (Photo provided/Rebecca Lomax)Strategies for Financial Independence

To achieve financial freedom, Lomax stresses the importance of debt reduction and building an emergency fund. She believes that altering our mindset about money is crucial for creating generational wealth. Teaching children about finances early on by involving them in financial decisions can lay a strong foundation for their future.

Programs like Dollars & $ense by 100 Black Men of America, Inc. are instrumental in teaching financial literacy to high school students. In Indianapolis, this program has been offered in collaboration with the University of Indianapolis for over 20 years. It aims to introduce students to finance and encourage them to pursue higher education, with scholarships awarded based on participation and performance.

Practical Financial Advice

Lomax advises prioritizing savings and establishing a budget to maintain financial health. Living within one’s means and maintaining a solid emergency fund are critical steps towards financial stability. She also recommends planning for the future by investing in education and markets and having legal safeguards like wills and power of attorney.

Financial planning should begin early, regardless of one’s current financial situation. Lomax encourages open discussions about financial goals and mistakes within families to foster financial responsibility. By implementing these practices, individuals can build a secure financial future and contribute to generational wealth.

Conclusion

Improving financial literacy is essential for achieving financial stability and growth. Through education, community programs, and family involvement, individuals can enhance their financial knowledge and skills. By adopting sound financial strategies and teaching these principles to future generations, we can build a foundation for long-term financial well-being.