On TikTok, a significant portion of the finance-related material is focused on economic literacy. Most of this information comes from personal celebrities, no banks. Neobank Chime and TikTok influencer Allison Baggerly, who both teach budgeting methods and techniques on the app, have recently teamed up.

While Baggerly’s methods for promoting budget management and making art are mainly focused on online tools like Excel, the channel’s collaboration with Chime introduces an grownup coloring book to consumers.

The painting text

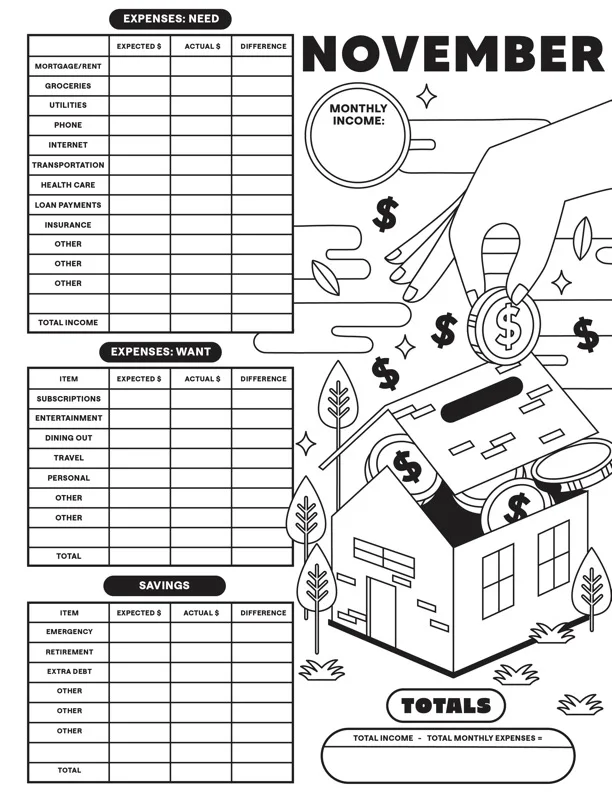

The 29-paged coloring book includes a site for each month with tables displaying expenses and savings as well as illustrations that users can shade in while making a budget. Additionally, there are dedicated websites for consumers to learn about how their financial progresses and what they might be saving up.

Baggerly wrote the chairs, which helped folks get started on their financial well-being voyage, by translating her lessons from TikTok into a written format. Steffi Lynn Tsai’s “upbeat design” gives the book an overall sense of “hope,” according to the neobank.

“This operation required me to consider budgeting in a completely different way!” Although I enjoy sharing tips on handling and budgeting, creating a budget in a coloring book required me to reevaluate the fundamentals of budgeting and how they could be put into practice. It was a fun project to work on with Steffi and Chime to create a template that will encourage creativity while also facilitating simple budget.

Baggerly goes on to say that the book will help people start budgeting and that it will provide a jumping-off point for more in-depth modern budgeting. While accounting is the visible task covered in the book, the coloring activity serves as a hook for customers and makes the potentially tedious task fun, engaging, and beautiful task.

For Chime, the coloring book, which it will sell for $1, is a way to address the lack of financial literacy in America. According to a study conducted by the Neobank, 32% of Americans claim to have no knowledge of funds in school.

“These findings pushed us to think a lot about how Chime can appear during Financial Literacy Month in a way that is both impactful and helpful as well as approachable and enjoyable for those who didn’t receive the fundamental financial education they needed as children,” said the report. Adult painting books have gained popularity over the past few years as a way to tap into childlike joy and learning, as well as as a way to reduce stress, so a coloring budget seemed to properly fit that description. We believed that coloring books would work well with a task like budgeting because it doesn’t have to be difficult or intimidating, according to Jennifer Dohm, head of consumer communications at Chime.

“The painting text builds upon the neobank’s recent partnership with Zogo, which offers its customers financial education materials and the ability to earn rewards. “Our partnership with Zogo and engagement with our MoneyMoves blog has shown us how engaged people become when learning is fun and interactive,” said Dohm.

Getting client relationship correct

Many standard Institutions have resources for learning about money. The issue, often, isn’t that these resources don’t exist but that customers don’t engage with them in meaningful ways.

“Banks have these beautiful sites, with tremendous economic training information, that they’re trying to get into the palms of the customers. But alas, 90% of the customers get right through the lovely site and go into online bank”, said Kathleen Craig, CEO and founder of Plinqit.

Some of the largest lenders in the United States have also raised problems similar to this. For instance, earlier this year, Dr. Julie O’Brien, head of behavioural research at US Bank, stated that despite producing material that engages users, it’s difficult to control what they are exposed to.

“We’re merely one message out of many voices, that can be very strong, in assessment”, she said in a Tearsheet radio.

What if FIs decided to speak out against their satisfaction and joined a group of 153 000 people in doing so? Chime and Baggerly are actually doing that: the neobank has access to thousands of potential customers who are interested in financial education, and Baggerly gets to know even more individuals by tapping into Chime’s users.

The interesting thing about this partnership is that the amplification doesn’t stop here. The painting text comes with a stamp of approval from the singer and rapper T-Pain, who also showed up and surprised college students with a Progress 101 class, where he shared personal finance tips and gave the students the coloring book to take home.

This celebrity-plus-influencer wedding technique is essentially unheard in the industry. The Mighty Oak cards partnership between Dwayne Johnson and Acorns is the most recent case. Additionally, in that instance, it was a finance that was adopting this tactic, not a classic Wall Street bank.

“It’s all about consistency and convenience! When a creator is featured on TikTok and is able to talk about budgeting in a fun, easy way, it really clicks. Influential figures are breaking down the big, spooky financing talk into manageable bite-sized pieces. Plus, it’s on websites where people are now spending their time. Custom Institutions come off as official, far, and almost as if they are talking down to you. It’s all about meeting persons exactly where they are, actually and figuratively”, said Baggerly.

Just look at Klarna. Financial brands that have acknowledged what this market can do for the business are able to generate revenue and relationship. The power of celebrity advertising is true. Traditional FIs frequently enjoy mentioning how their air of legitimacy and faith helps them stay in business despite the fact that the competition is getting more and more fierce.

But what happens when the definition of faith shifts from “who my kids used to banks with” to “I grew up learning from this FinToker and I trust their tips on who to bank with?”

This isn’t to say that there is a revolution on the horizon. Conventional lenders have a long history and are unlikely to end up in any other state anytime soon. Also, some neobanks have yet to figure out how to stay in the game long enough to be successful. However, their relationship techniques do demonstrate that conventional Institutions may not be able to rely on an “air of validity” for very long if their companies come across as less trustworthy.