This year, a group of high school pupils taught third-graders introductory financial education classes at Northwest Elementary. Lenoir County Early College High School students in the 10th grade had to share what they learned in economy with a little younger viewers of 15 years old.

Following meal, Ms. Green’s second- grade school turned their attention to a series of training on the basics of personal financing. Borrowing and lending were the key lessons of the day.

Valentina Bassett and Kailey Moore were the two who taught that training.

According to Bassett, “the main information I want to communicate is that they understand the dignity of lending and borrowing,”

It’s a great concept for primary children to grasp. They won’t be repurchasing a car loan at all in the near future. That’s why you have to discuss it in a way that refers, says Moore.

“We’re definitely incorporating stuff that kids enjoy, like ‘Your friend needs a beverage. Provide them $2.00.’ or “Your friend needs $6 for an ice cream cone, you hear the ice cream trucks coming,” Moore said. “Those are true child- based things. You mayn’t see an child running for an ice cream truck.”

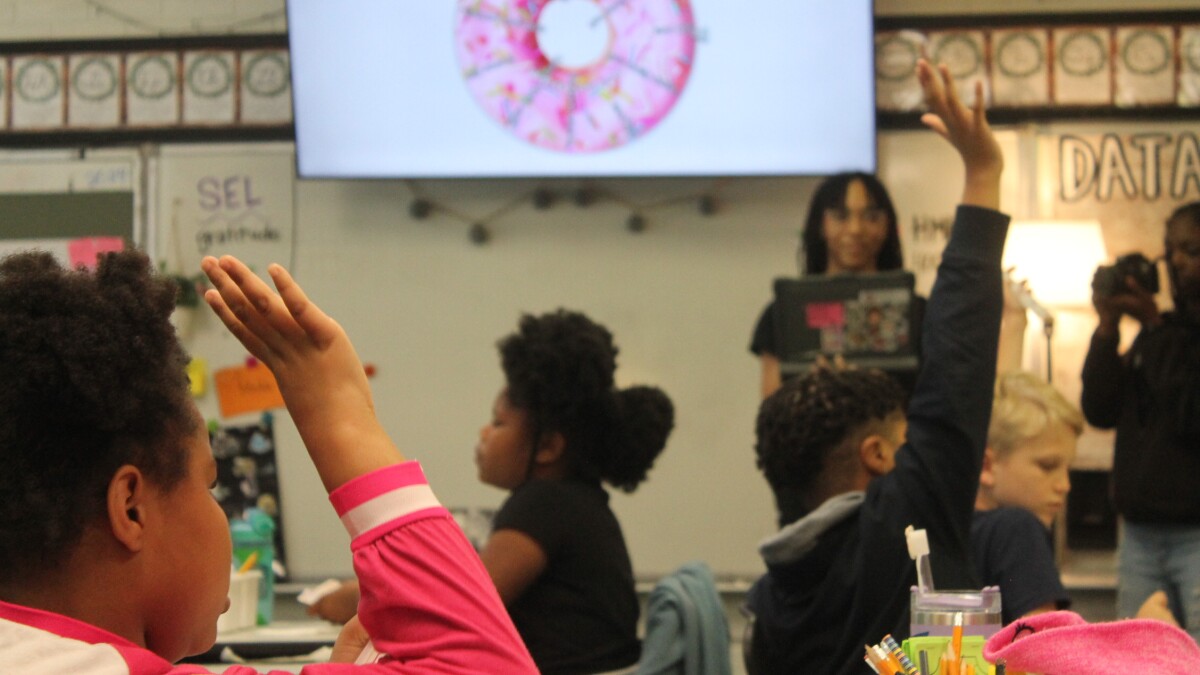

To strengthen the training, the students played a sport. With $50 of coated, wish wealth go accented with their teacher’s mouth, they had to borrow and lend that money to each other. Who gave out money and who received it was determined by Bassett spinning a vehicle in the front of the area.

After a few sessions, it came time to pay it back. The children settled their debt and received a new also $50.

A novel group of 10th grade led the next lesson, which was centered on budgeting. These Ms. Green’s 3rd- grade school learned the difference between needs and wants.

“So, take a seat in a candy shop and consider the treats and all your favorite chocolate bars, sticky animals, and other stuff like that. Well, those points are called needs,” William Anderson, one of the teachers, said.

The boys had a choice for how to spend their money for this task. They may buy books, clothing, an Xbox gaming system, or a computer, to name a few.

It was an training in accounting. Luke, a third-grader, exchanged the costly computer for more useful items.

The answer is to “don’t buy expensive things like your computer or phone because those take a lot of money,” Luke said. He chose, otherwise, to buy a cable and Wi-Fi.

The next lesson was on spending. To express the importance of saving, the children took component in a kind of study. They could either start with $20 and spend it on one sticker, or they could wait to make even more money and spend even more. The initial go around, only one person took the bit. The next day, a few more. Children may purchase five posters for all of the money by the end. The majority of the children stayed until the very close.

Similar types of classes are not common in younger levels. In the second grade, they do learn how to perform mathematics with money, but there is no emphasis on economic literacy.

In fact, only the High School of Economics’ Travis Towne teaches that training at the Early College High School, which is the only prerequisite for financial literacy in North Carolina. Additionally, he assisted the high school students in setting the training. He says it’s important to begin early.

Because many students in lower socioeconomic areas don’t have access to that resource, “One of the things we’ve really tried to do is push financial literacy knowledge in our schools,” he said. He added, with that information in side, it’ll help kids learn how to make wise financial decisions when they’re older.

Bassett taught her Borrowing & Lending 101 lessons to each of Northwest’s three 3rd level rooms. She claimed that they had learned to concentrate on specific things to keep students interested.

“We had one at every table so people may question questions, and we really really emphasized borrowing and lending,” she said. “We wanted to make sure it was instilled in them.”

The Jump$ dessert Coalition, a national organization that raises awareness about the value of financial education for young folks, used the instructions to inform the lessons. One of the over 130 great schools in 44 says that takes part in Teen Teach-In activities in April is Lanoir County Early College High School.