The Psychological Influence on Retirement Savings

Understanding the psychological aspects of saving for retirement can significantly affect how individuals prepare for their future. A recent study by Goldman Sachs Asset Management and Syntoniq involving over 5,000 US workers and retirees underscores the profound impact of psychological factors on retirement savings behaviors. The research identifies four key emotional traits—financial literacy, optimism, risk preference, and planning—that enhance one’s ability to save effectively for retirement.

Optimism and Financial Literacy: Drivers of Retirement Preparedness

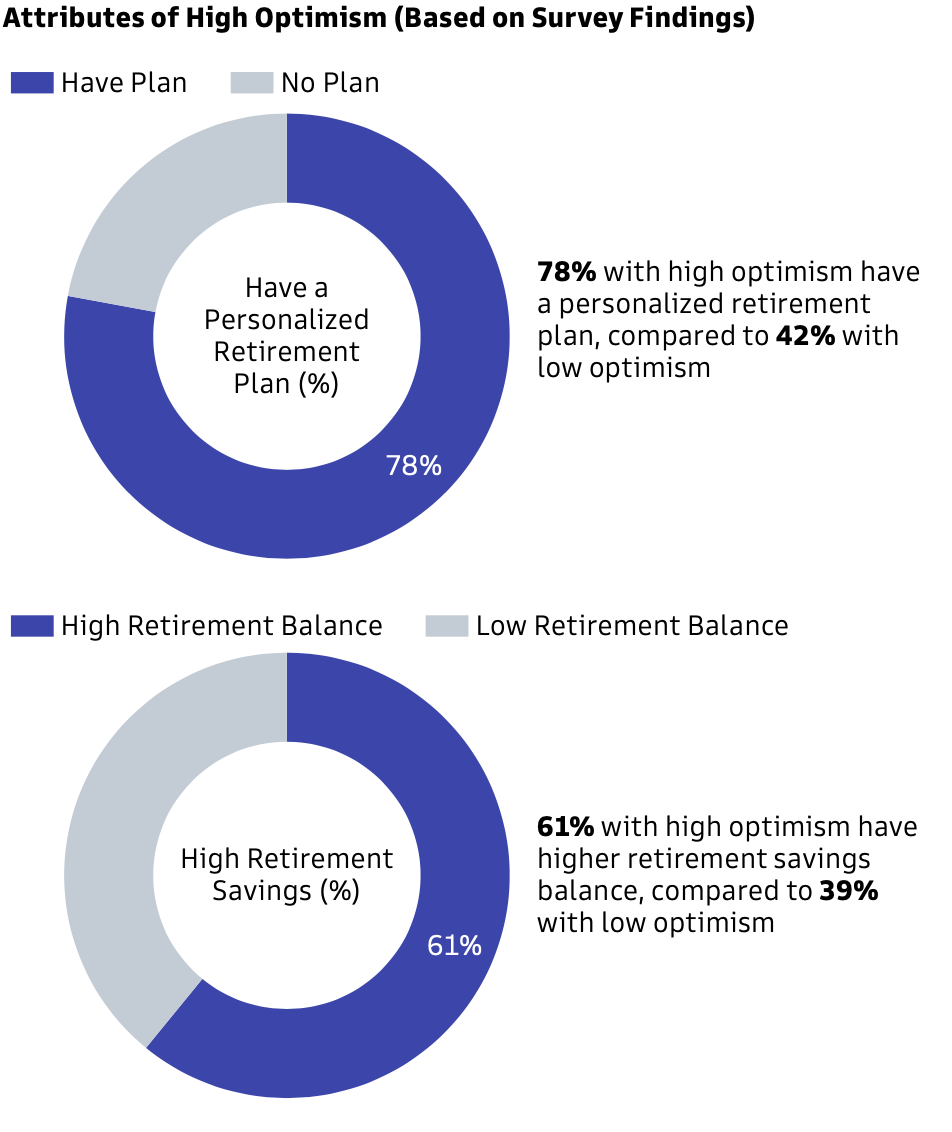

Optimism and financial literacy emerge as critical drivers, with the study revealing that individuals who possess these qualities tend to maintain better financial habits and accumulate higher retirement savings. Those with an optimistic outlook are more likely to engage in regular financial planning and review, which includes maintaining emergency funds and avoiding premature withdrawals from retirement accounts. Furthermore, the study found that individuals who score high on financial literacy are more adept at navigating financial challenges and making informed investment choices, which significantly boosts their savings.

Empowering Financial Decisions Through Education

The intersection of financial education and retirement planning provides a roadmap for individuals to enhance their long-term financial security. The study suggests that fostering a combination of financial knowledge and an optimistic outlook can lead to more disciplined and goal-oriented saving strategies. It also highlights the necessity for continuous financial education to adapt to changing economic conditions and to ensure individuals are prepared not just to save, but to invest wisely in their future, potentially increasing their financial stability and peace of mind in retirement.