MAGNA, Utah (KUTV) — At a time when the country grapples with staggering levels of student loan and credit card debt, teaching financial literacy to young people is important as they step into financial independence.

According to the Household Debt and Credit Report published by the New York Fed in February 2024, credit card balances increased to $1.13 trillion in the last quarter of 2023. Student loan debt remained unchanged at $1.6 trillion. The report also said car loan balances are up and more people, especially young people, are falling behind on credit card and car loan payments.

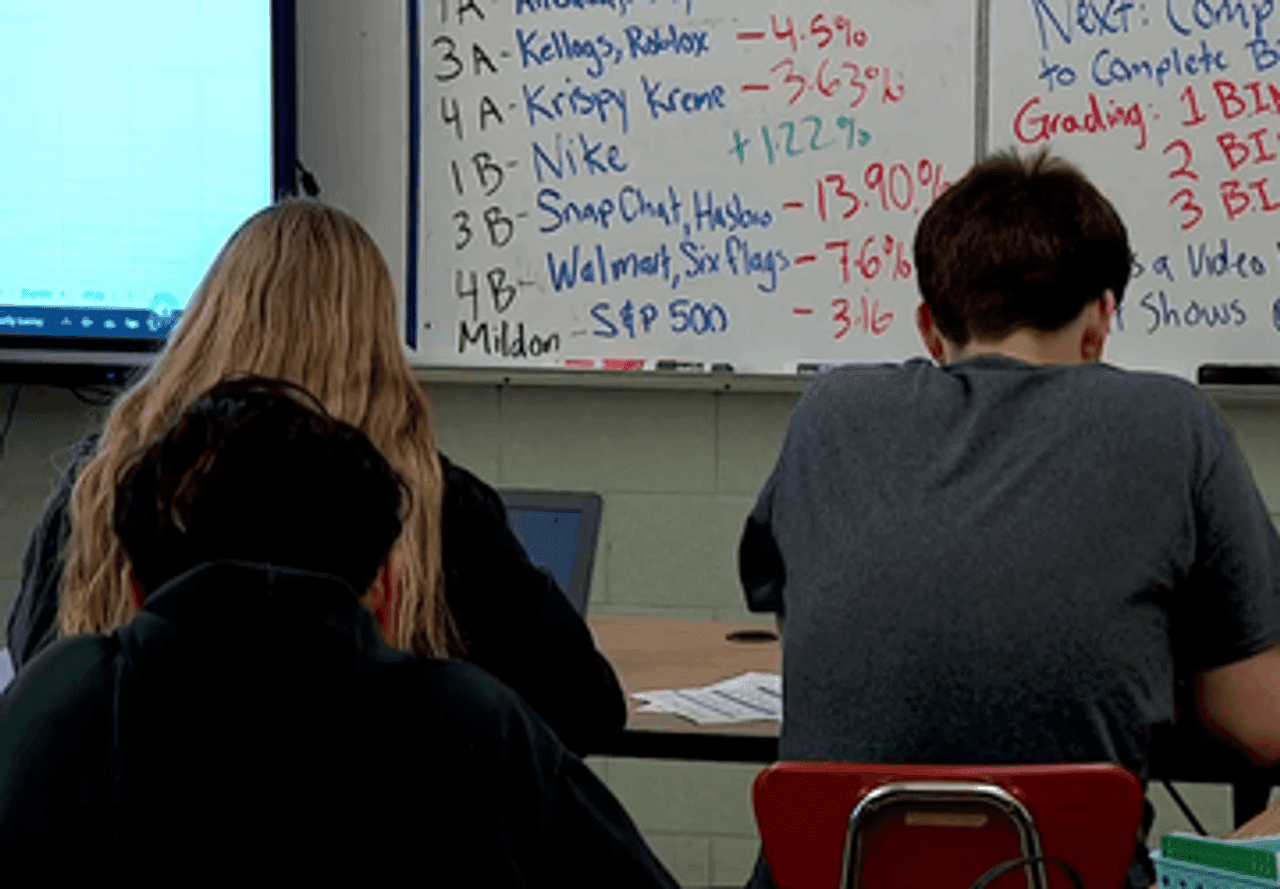

At Cyprus High School in Magna, 11th graders dove into the intricacies of investing as part of their financial literacy curriculum.

Football player Uha Malekamu, who has straight As, found the class inspiring. He’s already thinking about how he’ll manage his money in the future in order to help his family.

“Investing, it’s pretty cool,” he said.

The course, designed to set young people on the right financial path into adulthood, covers a spectrum of topics including budgeting, investing, responsible spending, and managing debt.

Tyler Garcia, the Granite School District’s Financial Literacy Program Manager, said students take great interest in lessons about investing and compound interest.

The class for 11th graders is one semester, but Garcia would like to see it extended.

“If they would make it a year long class, I think that would be better. That’s how important I think it is,” he said.

The curriculum doesn’t just stop at investment strategies. It also addresses practical concerns such as paying for college — a pressing issue for students like Uha, who wants to attend BYU but is already considering scholarship applications and other means to fund his education without taking on unnecessary debt.

Taysha Clinch, also a junior in the class, had similar concerns.

“I think about what I’m going to do in the future with my money because I want to go to college,” Clinch said.

Cassandra Fuentes, Financial Education Manager at Mountain America Credit Union, said financial success depends on what teens learn at school and at home. She emphasized the role of parents in initiating conversations about financial goals and priorities early on, providing a foundation for good money management.

She suggested parents start the conversation by asking their kids who they want to become as adults.

“When they understand what’s most important to them, they can begin to use money as a tool,” she said.

She said helping kids set a budget with money from an allowance or a summer job is a great way to teach financial responsibility.

While credit cards can be a good way to help young adults build credit, Fuentes suggested parents emphasize the importance of paying off the credit card balance every month.

Mountain America Credit Union offers an online course to help parents and children with financial lessons.

Additional resources recommended by Granite School District include EVERFI, Next Gen Personal Finance and curriculum from Cyprus Credit Union.