The money is looking fierce. Cash has flooded into the region’s markets as the dollar has shot up, and the dollar has soared as the economy has grown steadily and investors have trimmed back on bet that the Federal Reserve will cut interest rates. It has risen by 4 % this month, measured against a trade- balanced box of currencies, the basics point to deeper understanding. The world is in the middle of a new phase of strong-dollar geopolitics as a presidential election is drawing near and both Democrats and Republicans are determined to support American manufacturing.

The fact that the stock’s durability reflects weakness somewhere makes this situation even more difficult. By the end of 2023, America’s economy was 8 % larger than at the end of 2019. Those of Britain, France, Germany and Japan each grew by less than 2 % during the same time. The japanese is at a 34- time low against the money. The euro has dropped from$ 1.10 at the start of the year to$ 1.07 ( see chart 1 ). Some traders are now predicting that the couple may be parity by the start of the year.

If Donald Trump win in November, the picture is so set for a battle. A solid dollar tends to raise the price of British exports and lower the price of goods, widening the government’s persistent trade deficit—a hobgoblin of Mr Trump’s for many years. Robert Lighthizer, the engineer of tariffs against China during Mr Trump’s day in the White House, wants to undermine the money, according to Politico, a news site. Although President Joe Biden has not made any official announcements regarding the money, the strong dollar also complicates his manufacturing goals.

Abroad, a mighty greenback is good for manufacturers that have expenses denominated in different currencies. However, a strong dollar and higher interest rates in the United States contribute to imported inflation, which is now being exacerbated by fairly high oil prices. In addition, businesses that have borrowed in money face steeper payments. On April 18th Kristalina Georgieva, brain of the IMF, warned about the effects of these innovations on global financial stability.

Many countries have ample foreign- exchange reserves that they could sell to bolster their currencies: Japan has$ 1.3trn, India$ 643bn and South Korea$ 419bn. But any pleasure may be temporary. When the Fed began raising interest rates, income slowed the conditioning of the money in 2022, but they did not stop it. Central institutions and finance ministers squander their wealth by engaging in pointless conflict.

Another choice is global co- ordination to end the greenback’s climb. The origins of this were revealed on April 16th when the finance ministries of America, Japan, and South Korea jointly declared their concern over the yen’s collapse and prevailed. This may be the forerunner to more treatment, in the form of combined sales of overseas- exchange reserves, to avoid the two Asian currencies from weakening additional.

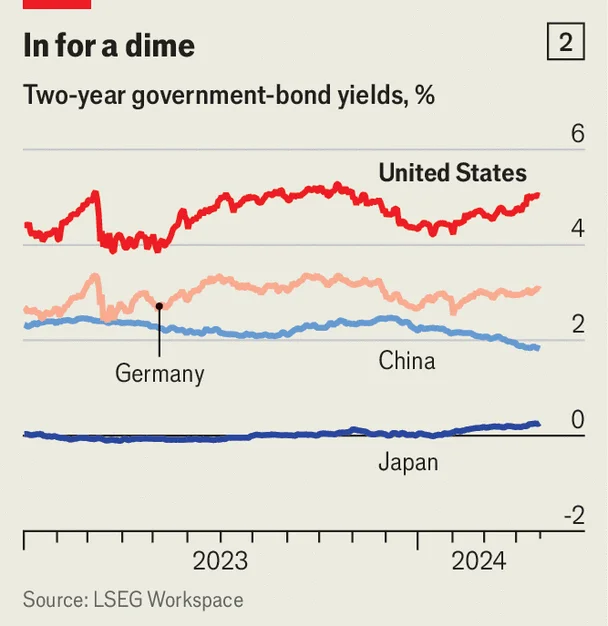

However, economics is inevitably tearing these nations apart, despite their best efforts to be on the same site. After all, the difference in interest rates between America and other nations is what causes the renminbi and wo n’s failure. American Treasuries maturing at the same time as South Korea’s two-year government bonds offer a return of 5 %, while Japan’s two-year government bonds offer a return of just 0.3 % ( see chart 2 ), while Japan’s two-year government bonds offer a return of 3 % ( see chart 2 ). Investors seeking returns have a simple choice to make, and their choices may strengthen the money if interest rates continue to rise sharply in America.

Additionally, there are nations where America is less likely to co-operate. According to Goldman Sachs, a bank, China saw$ 39bn or so in international- change outflows in March—the fifth most of any quarter since 2016—as investors fled the country’s falling market. Since the beginning of the year, the yuan has gradually weakened against the money, and more quickly since mid-March, when the renminbi has increased from 7.18 renminbi to 7.25. Bank of America expects it to attain 7.45 by September, when America’s election campaign will be in full stream. That may give China’s most recent trade push a raise and put the renminbi at its weakest since 2007. Foreign electric cars may be on the verge of lowering their prices.

Even populists in America may be willing to ignore friends ‘ fragile economies, at least for a moment. For China, they are less likely to do so. This raises the risk of additional taxes and punishment, and maybe even the return of China to America’s record of money schemers. As long as America’s market outperforms, the money is likely to stay strong. And trade tensions are sure to rise as long as British politicians consider that to be alarming.