Economic Challenges and the Rise of Emergency Loans

In Nigeria, the harsh realities of economic hardship are driving an increasing number of individuals towards emergency loans to manage daily expenses. As the nation grapples with economic instability that pushes more people into poverty, there’s a growing dependency on low-cost emergency loans. This surge is largely driven by high inflation and insufficient government poverty alleviation programs, which have strained personal finances considerably.

The Predicament of High-Interest Rates and Predatory Practices

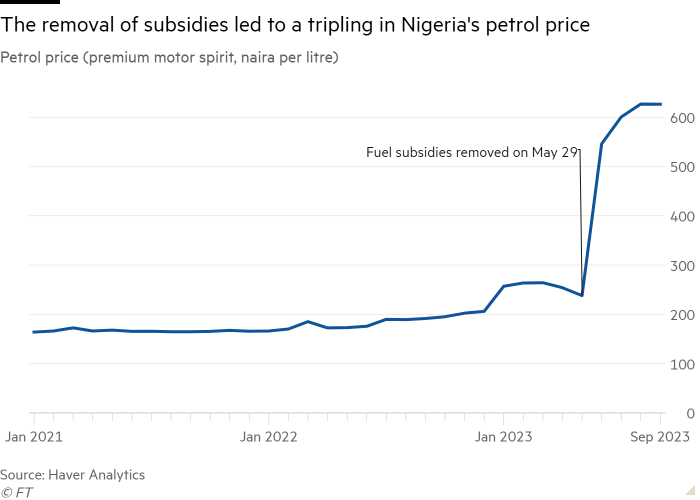

Amid these financial challenges, the prevalence of payday loan providers has soared, offering quick fixes that often lead to long-term financial traps. Individuals like Samuel, a small business owner in Lagos, find themselves caught in a cycle of debt, compelled to take on multiple high-interest loans to manage existing debts. This scenario is becoming all too common as individuals struggle to cope with the rising cost of living, including a significant increase in food prices and transportation costs.

The Impact of Fintech and Financial Education

The financial landscape in Nigeria is further complicated by the activities of nearly 200 licensed digital lenders, some of which engage in practices like contacting borrowers’ personal connections to enforce repayments. These fintech companies, exemplified by names like OKash and Palmcredit, often bypass traditional banking safeguards, offering loans at rates substantially higher than those of traditional banks. As the government and financial experts push for better financial education, it’s crucial for Nigerians to understand the implications of these quick financial solutions and seek sustainable ways to manage their economic challenges.