Impact of Decreasing Short-Term Loans on Bangladesh’s Economic Health

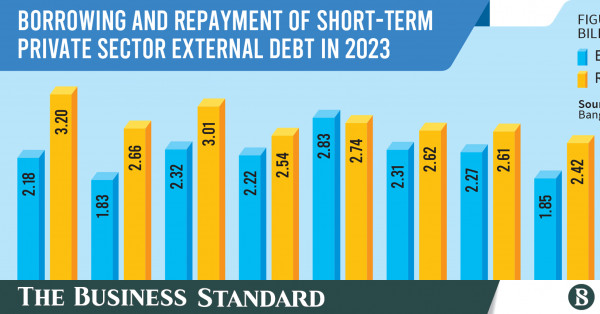

Bangladesh’s banking sector is facing significant pressure as repayments on short-term external loans outpace new borrowing, leading to a substantial drain on the nation’s foreign exchange reserves. Recent data from the central bank highlights a troubling trend: the country has repaid $24 billion in short-term foreign loans in the first eight months of this year, which surpasses the amount borrowed by about $5 billion. This has resulted in a sharp decline in foreign exchange reserves, with the total external debt of the private sector reducing from $16 billion at the end of the previous year to $12.42 billion.

The Domino Effect of Financial Strain

The surge in repayments has exacerbated the loss of foreign reserves, raising concerns about the overall economic stability of Bangladesh. The country’s financial health is further strained by an increasing short-term external debt, which now demands $65 for every $100 in reserves, up from $30 two years ago. This imbalance poses a severe risk to the country’s financial autonomy and has shaken the confidence of foreign financiers and investors.

Strategic Adjustments and Long-Term Implications

To combat these challenges, experts suggest that Bangladesh needs to enhance its short-term loan inflows to stabilize the financial account surplus. This requires attracting between $14 billion and $16 billion in new loans to effectively manage the $12 billion in net repayments necessary to maintain economic health. However, the reduced inflow of short-term loans, heightened by the reluctance of both local firms and international lenders due to the increased lending costs and risks, calls for a strategic reassessment of financial policies to ensure sustainability and restore investor confidence.