According to a Bangladesh Bank report, state-owned provider Agrani Bank is facing difficulties in recovering the substantial Tk790 billion loans it extended to seven businesses of the Thermax Group, which owe nine banks a total of TK1,822 million.

As per a statement from the central bank, Agrani Bank elevated its credit risk by extending loans to these businesses without adequately assessing their creditworthiness and by not considering the liability of other banks when disbursing funds.

The seven entities, operating six foreign currency schemes under the Export Development Fund (EDF) facility, collectively borrowed Tk790 billion, equivalent to Tk252 million, which is now overdue. However, after the repayment period lapsed, Bangladesh Bank subsequently debited the equivalent sum from Agrani Bank’s foreign exchange accounts.

“We provided the funds to Thermax companies in dollars,” said a senior Agrani Bank official. “Since the businesses failed to repay the loan on time, the central bank withdrew the money from our accounts.”

In March of this year, a Bangladesh Bank assessment team reviewed the loans extended to Thermax businesses.

Exporters can utilize the EDF, a specialized service offered by the central bank, to facilitate the import of raw materials through monetary loans. Companies have up to 270 days to repay these loans. Despite the Thermax affiliates’ failure to export products in line with their commitments, the central bank did not find the goods in the group’s warehouses. The central bank’s report also indicated that the companies provided insufficient details on how they intended to repay these foreign currency loans.

All overdue EDF funds from Thermax entities have been converted into non-performing loans, according to Fazlul Hoque, the general manager of Agrani Bank’s main branch in Motijheel, Dhaka, which sanctioned the loans. The loans have been rescheduled in accordance with the central bank’s prescribed down payment criteria. The debts are now classified as non-performing.

In response to the central bank’s observation that other banks did not appropriately assess the liability of other institutions while lending to Thermax companies, Fazlul Hoque stated, “Our loans were granted in accordance with the proper guidelines of the board.” Delinquencies have occurred due to the impact of global economic turmoil.

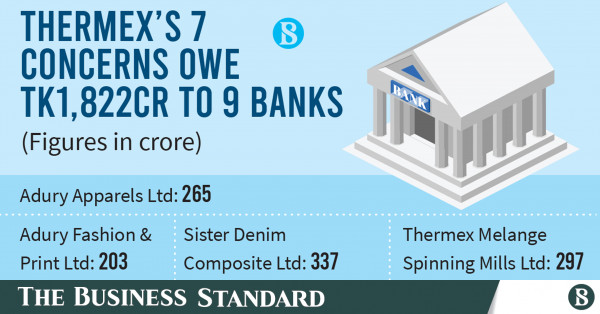

Total Loan Owed: Tk1,822 billion to 9 Banks

According to data from the central bank, the seven Thermax Group entities owe a combined Tk1,822 billion to nine different banks, with Agrani Bank holding the largest share.

Another bank that was not mentioned in the report is Social Islami Bank, in addition to United Commercial Bank. It also includes Islamic Bank Bangladesh, Rupali, Janata, and Al-Arafa Islamic banks. NRBC Bank and Sonali Bank are the other Sharia-based banks.

According to the Bangladesh Bank report, Thermax Blended Yarn Limited has outstanding debts of Tk566 million to six institutions, including Agrani Bank, with Tk366 billion of these loans currently unpaid. The company had obtained 14 LCs (Letters of Credit) worth $10.89 million for the import of textile raw materials but failed to repay them within the stipulated 270 days. Consequently, Bangladesh Bank debited Tk98 crore from Agrani Bank’s foreign currency accounts.

Adury Apparels Ltd. owes Tk339 billion to three banks, including Agrani Bank, with the outstanding balance now standing at Tk265 billion. The company claimed to have an annual production capacity of 54 crore pieces, but the central bank’s inspection team found that it could produce only 2.48 billion pieces of clothing, suggesting that the company had misrepresented its production figures.

Similar discrepancies were identified in other entities within the group.

Fazlul Hoque noted that the bank’s current lending policy is aiding these businesses in maintaining their operations while seeking resolution. “So, if we receive Tk100 from the company’s commercial activities, we provide a fresh back-to-back loan facility of Tk80, thereby sustaining the normal flow of client business.”