Empowering Gen Z with Credible Financial Guidance

Gen Z’s inclination to challenge traditional norms extends into their financial habits, reflecting a proactive stance towards securing their economic future. Cicely Jones, a Forbes contributor and financial expert, emphasizes the importance of consulting reliable sources for financial advice. Recommended sources include peer-reviewed academic research, certified financial professionals like CPAs and CFAs, and respected fund rating agencies such as Morningstar. It’s crucial for young investors to be skeptical of advice that sounds too absolute or urgent without verification from credible, established sources.

Personalizing Financial Plans for Gen Z’s Unique Needs

Acknowledging the unique characteristics of Gen Z is essential when devising personal financial plans. As a generation that ranks as the most educated and has grown up in a digital world, Gen Z has distinct advantages and challenges. Jones suggests incorporating personal educational experiences and access to vast information into financial planning. Whether it’s utilizing visual aids like vision boards to set and review goals, or leveraging advanced digital financial tools, tailoring the approach to fit personal learning styles and lifestyles can enhance financial understanding and management.

Adopting Smart Financial Habits Early On

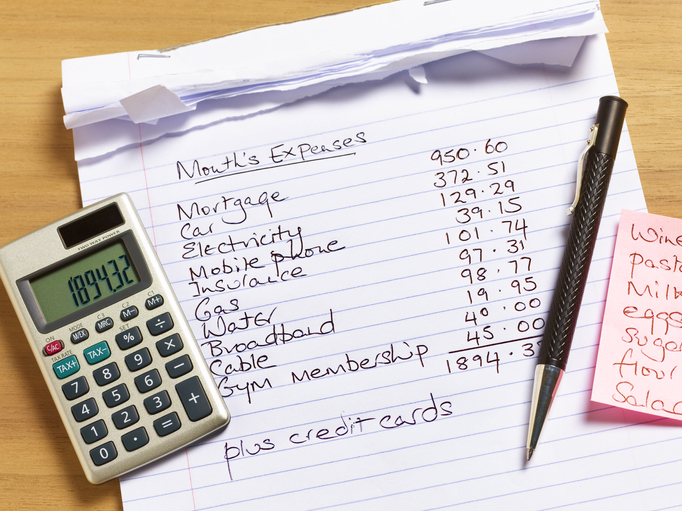

For Gen Z, adopting a balanced budget is more effective than extremes of saving or spending. Jones advises maintaining a budget that aligns with one’s long-term lifestyle aspirations, allowing any surplus to be channeled towards significant financial objectives. Avoiding lifestyle creep, where rising expenses continuously match income increases, is crucial. By establishing a disciplined budgeting practice, young individuals can prevent the cycle of living paycheck to paycheck, setting a solid foundation for financial stability and growth.