Expanding Financial Education in U.S. High Schools

In response to growing economic disparities highlighted during the pandemic, U.S. schools, including Hillside High School, are increasingly integrating financial literacy into their curricula. The Center for Financial Literacy at Champlain College recently released a report grading states on their effectiveness in delivering personal finance education. The report highlights a significant move towards making financial literacy a core subject, essential for preparing students to handle financial realities in adulthood.

The Role of Financial Education in Economic Equality

The importance of financial literacy has never been more pronounced as economic challenges such as income inequality and the complexities of financial products continue to grow. The report indicates that students equipped with financial knowledge exhibit improved credit scores and are less likely to fall prey to high-risk financial behaviors like payday lending. Notably, states like North Carolina are leading the way, having implemented financial literacy graduation requirements well ahead of others, aiming for widespread financial competence among graduates by 2026-2027.

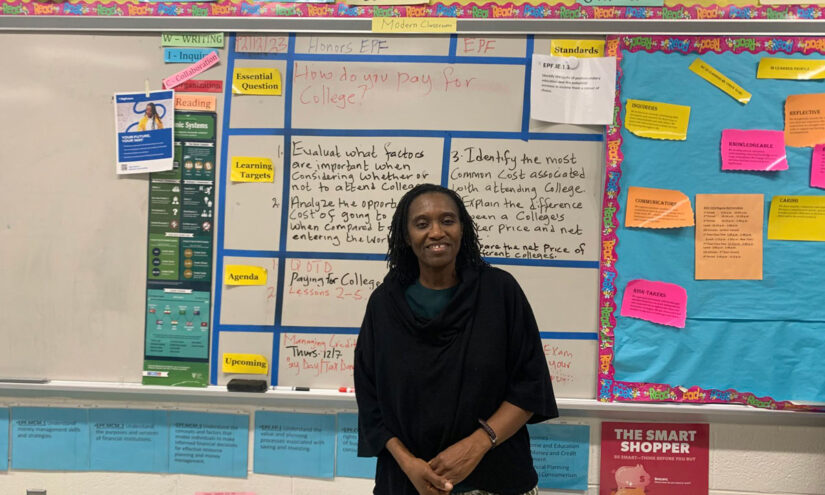

Professional Development and Impact on Teachers

The North Carolina Council on Economic Education has been proactive in offering professional development to educators, ensuring they are well-prepared to teach these crucial skills. Teachers who have undergone this training report a significant increase in their own financial understanding, helping them better educate their students about the complexities of financial management. This initiative not only enhances the financial well-being of students but also equips educators to impart practical financial knowledge effectively, thereby supporting a holistic approach to education that addresses both immediate academic needs and long-term life skills.