The Disconnect Between Knowledge and Application

Financial literacy encompasses a wealth of information that empowers us to manage finances effectively; however, the real challenge lies in applying this knowledge. While humans possess the unique ability to accumulate and disseminate vast amounts of data through books and historical records, translating this theoretical knowledge into practical application remains a significant hurdle. Valerie Chapman, a former banker turned educator, stresses the importance of financial education from an early age, particularly emphasizing the necessity for children in diverse communities to gain financial competence to secure a stable future.

The Critical Role of Financial Intelligence Quotient (FQ)

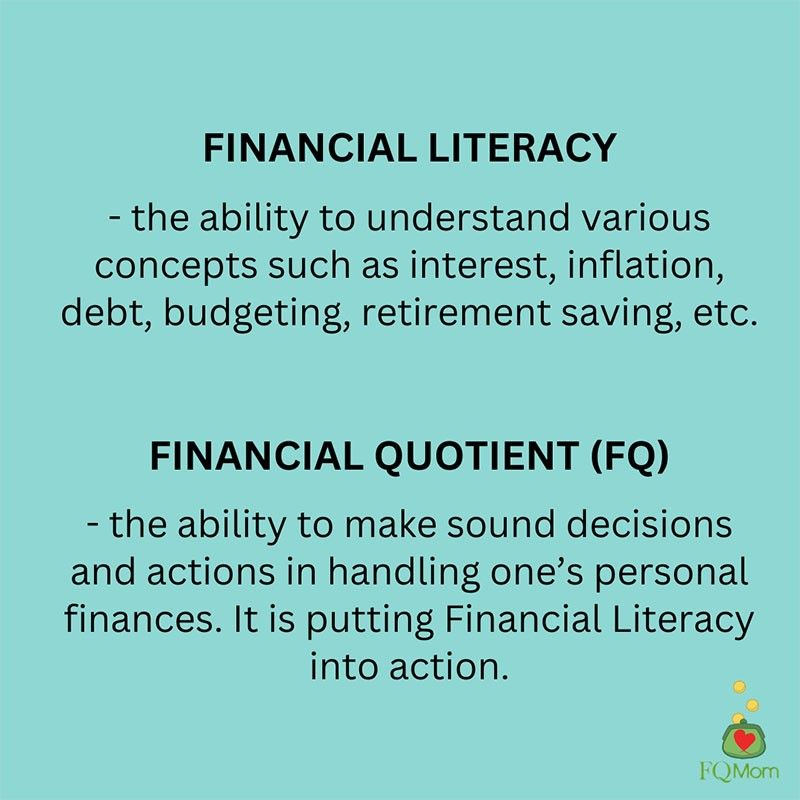

Financial literacy enables the understanding of key financial concepts like interest rates, debt management, and budgeting. However, possessing knowledge is different from effectively applying it, which is where Financial Intelligence Quotient (FQ) comes into play. FQ involves making informed and beneficial financial decisions and behaviors, serving as the practical application of financial literacy. It’s akin to combining IQ and emotional intelligence (EQ) but focused on financial decisions. This integration is crucial because without the active application of learned financial concepts, possessing knowledge alone is insufficient for achieving financial stability.

Immediate Consequences and Long-term Implications

The gap between understanding financial principles and applying them effectively can be likened to the immediate reaction of withdrawing a hand from a hot stove due to pain—a direct and instant consequence. However, many financial decisions do not offer immediate feedback, making it challenging to recognize the long-term effects of our financial behaviors. For instance, sporadic indulgences may not seem harmful initially, but consistent poor financial choices can lead to substantial negative outcomes over time, such as inadequate retirement savings or overwhelming debt. Recognizing the delayed consequences of financial decisions is vital for cultivating a discipline that aligns with long-term financial health and success.