Expanding Financial Literacy in Hispanic Neighborhoods

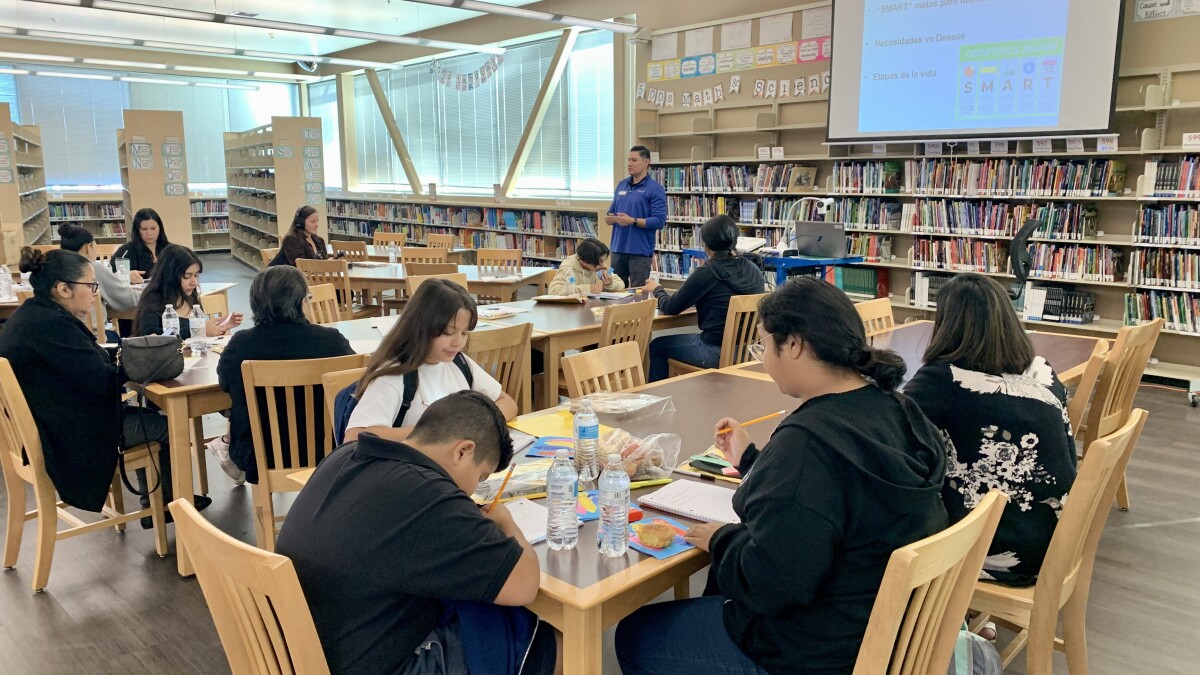

In Los Angeles, a financial education initiative aimed at Hispanic families is making strides in improving financial wellness. At a recent event in Bell, Everardo Velasquez, a financial educator with SchoolsFirst Federal Credit Union, addressed a gathering of parents and children at Magnolia Science Academy, detailing budgeting techniques tailored to sustain their economic stability. He emphasized that essential expenses, including housing and transportation, should align with specific income percentages to maintain a balanced budget.

Addressing Economic Challenges with Community Support

These educational sessions come at a crucial time as many Hispanic families are still grappling with the financial aftermath of the pandemic. Stories shared by participants like Teresa Mendoza reveal the hard economic choices families had to make, such as switching to less expensive food options to cope with lost income. These narratives highlight ongoing struggles with rising living costs, further exacerbated by factors like increased fuel prices which impact their daily budget significantly.

Sustainable Financial Practices and Local Aid

Magnolia Science Academy and local financial educators are actively working to provide resources that help families manage their economic challenges more effectively. Workshops on financial literacy, such as distinguishing necessary expenses from discretionary spending, are part of these efforts. Additionally, local support programs offer tangible aids like food pantries and financial assistance, which are crucial in helping community members stabilize their finances during recovery periods. These collective actions aim to equip Los Angeles’ Hispanic population with the tools needed for long-term financial resilience.