The Importance of Financial Literacy

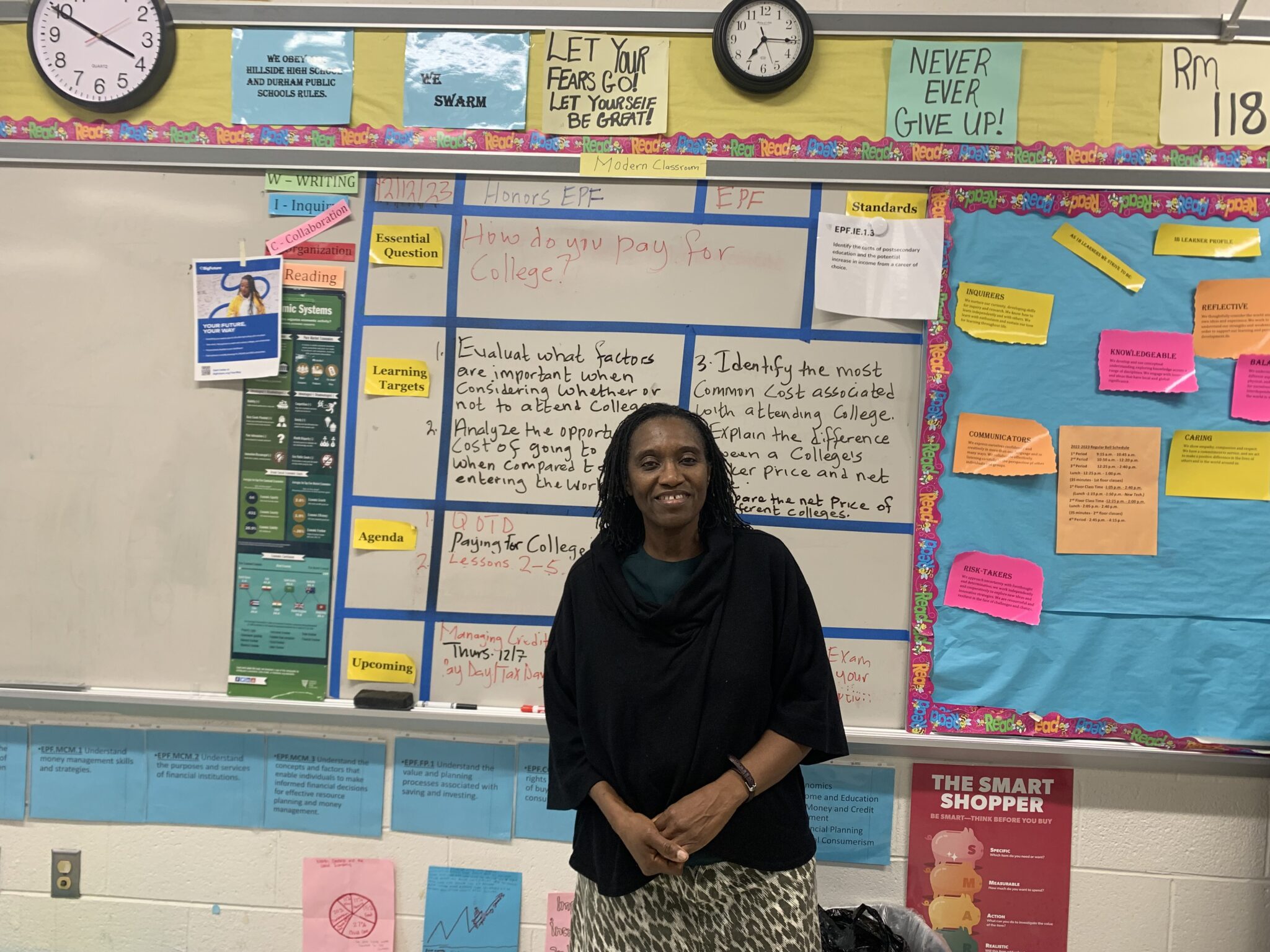

With a focus on personal finance and economic education, Ms. Ogede leads her economy and personal finance class with clear goals and objectives. According to Chantal Brown for EducationNC, students at Hillside High School, led by Shianyisimi Ogede, are actively learning about financial literacy. One of the critical topics covered is the importance of financial aid for higher education, especially with this year’s FAFSA opening in December instead of October.

Evaluating Financial Education in North Carolina

In December, the Champlain College Center for Financial Literacy in Vermont released a report grading each state on its implementation of financial education in high schools. The report highlights the increased focus on financial education due to the pandemic’s spotlight on income inequality. North Carolina received a “B” grade, indicating room for improvement compared to other states.

Financial education in high schools has shown to improve credit scores, reduce mortgage delinquency rates, and decrease reliance on risky financial services like payday loans. Seven states earned an “A” for ensuring students have access to personal finance courses by graduation. North Carolina is expected to join these top-performing states within five years, currently ranking with a “B.”

Enhancing Financial Literacy Programs

The availability of free online curricula from government agencies and institutions has been crucial in developing these courses. By 2028, states with an “A” or “B” grade could have 30,000 well-trained personal finance educators. In 2019, North Carolina passed legislation requiring financial literacy as a graduation requirement.

During the summer of 2020, the North Carolina Council on Economic Education (NCCEE) provided online professional development for the new program. The training included presentations from NCCEE, NextGen Personal Finance, The Federal Reserve Bank of Richmond, and Marginal Revolution University, totaling 40 hours of professional growth. The training also featured assessments, group activities, and access to free resources to support teachers in delivering the course.

Real-Life Financial Skills

Sandy Wheat, executive director of NCCEE, noted that after the training, teachers felt more confident in their financial knowledge. Some teachers realized the importance of understanding compound interest and its impact on debt and investments. This knowledge helps them manage their finances better and pass on valuable lessons to their students.

Financial literacy is crucial during and after high school, as many parents feel unequipped to teach their children about money. Schools are stepping in to fill this gap, especially for students of color who might lack access to essential financial education. Ms. Ogede’s students learn about credit management, investment, and the value of good credit scores through practical projects and real-world applications.

Addressing Economic Inequality

Ms. Ogede emphasizes that good credit is a key indicator of financial success in America. Many students, particularly those from Black and Brown communities, lack a family history of financial literacy. Teaching these skills in schools helps bridge this gap and prepares students for future financial responsibilities.

Sandy Wheat highlights the complexity of today’s economic environment and the growing responsibility individuals have for their financial futures. “People used to rely on company benefits, but now they must take control of their financial destinies,” she says. Offering personal finance education helps students make informed decisions and improves their long-term economic prospects.

Impact of Financial Education

Providing a personal finance program aligns with the needs of the community and prepares students for a successful future. Wheat explains that even small adjustments in financial education can significantly impact students’ lives. Encouraging students to stay in school and pursue higher education can lead to better earning potential and a more secure financial future.

Feedback from teachers who completed NCCEE training has been positive, with many finding practical applications for their newfound knowledge. Understanding financial principles helps students see the real-life relevance of their education and prepares them for financial independence.

For more information about financial education standards in North Carolina, refer to the detailed training requirements provided by NCCEE.