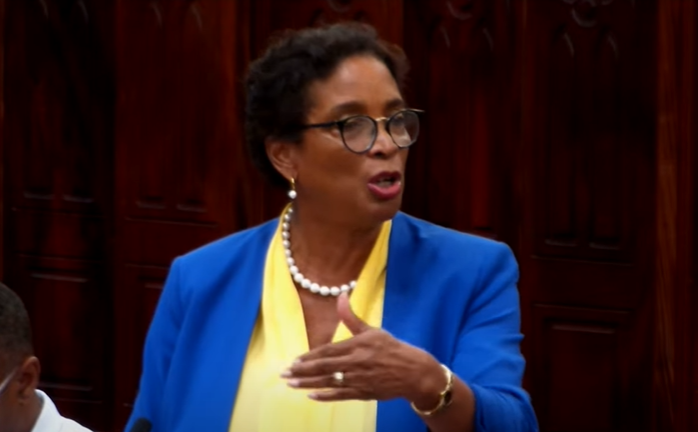

The elderly should be taught financial education, according to Sandra Husbands, minister of state in international trade and business, in order for them to live comfortably in their later years.

Seniors needed more financial training, according to her, as many of them were having trouble managing their financial affairs. This was one of the main lessons the COVID-19 crisis had taught them.

Speaking during the House of Assembly’s National Insurance and Social Security (Amendment) No. We have so many elderly who are currently dependent on their National Insurance income, but with the rising cost of living, it is a challenge for them to handle that money, according to Bill, 2023, Husbands, who has been emphasizing the importance of teaching economic education to all segments of society. It’s a challenge because their families are even having trouble helping them survive easily after the COVID-19 recuperation.

Since there are many people in the area who abuse the elderly because of their money, one of the things we recognized was that we needed to have financial literacy education with our elderly to help them understand what are some steps, first of all, they need to get against the ravages of abusers. [We want] to explain to them some of the safety measures they should take to make sure that those in charge of paying their bills aren’t being dishonest.

Husbands also emphasized that the current administration should pay close attention to retirement planning knowledge. She claimed that far too many Residents also hold the outdated notion that NIS will always be their only source of retirement income.

She stated, “We want to assist them in realizing that there is more they can do to set aside someone to help them through their retirement stage. Not only with our elders but also with middle-aged people and our young people, we want to do that. They will be able to earn enough money if they can get started earlier, so they should be in a position to support themselves in their older age and lead comfortable lives.

(SB)