After a recent ruling by Germany’s top court forced Chancellor Olaf Scholz’s government into a major fiscal overhaul, Germany will suspend the legal limit on new online borrowing for the fourth consecutive year.

People familiar with the matter, who requested anonymity when discussing personal information, stated that the suspension had already been agreed upon by the ruling coalition and would be ratified when Lindner presented a revised budget for the second year of 2023.

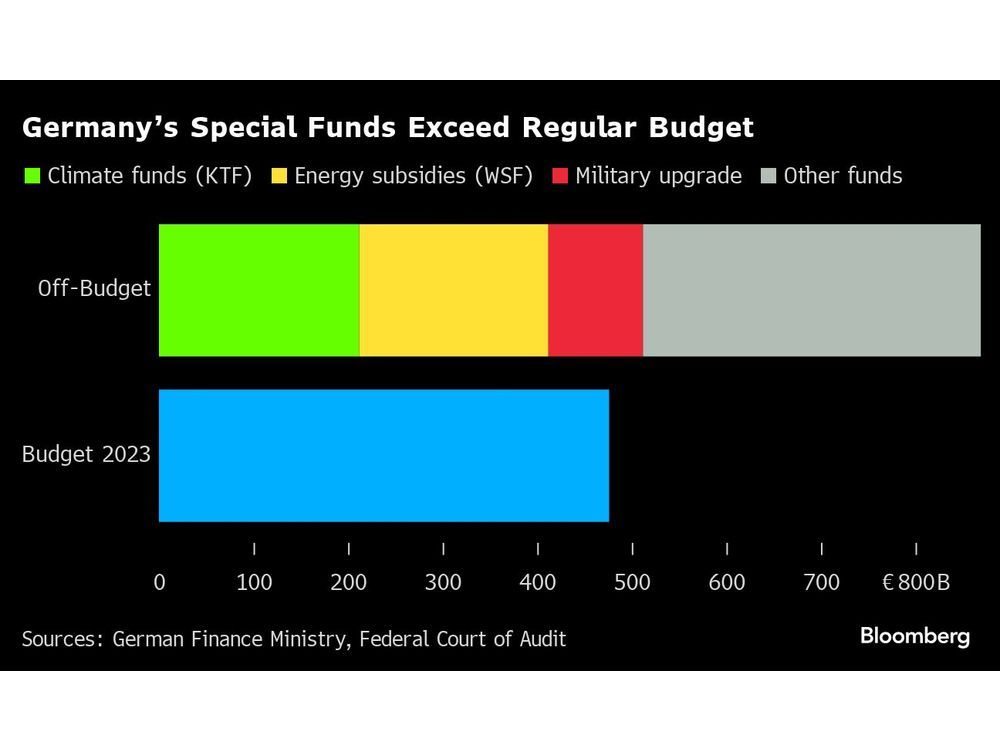

He is compelled to take such drastic action because he must retroactively account for €37 billion ($40.3 billion) of new off-budget debt intended to alleviate the burden of high electricity and gas prices on households and consumers.

The president of the fiscally conservative Free Democrat party, who had insisted on reinstating the debt reduction after its suspension due to the pandemic and the energy crisis, now faces a humiliating climbdown.

Lindner pledged that the government would put spending “on a constitutionally protected footing” and stated, “I see it as my duty to clear the air today.”

Following the announcement, German debt experienced extended declines, pushing 10-year yields up by as much as six basis points to 2.62% in response to the potential for additional borrowing. Gains were offset by the premium on swaps over matching bonds, a crucial gauge of supply risk, which brought the spread close to its lowest level since February of last year at 52 basis points.

Initially, Lindner had been able to fulfill his promise to reinstate the debt brake for the regular budget this year by utilizing the special funds. However, he also directed funds to support the rejuvenation of Germany’s industrial base and efforts to reduce harmful emissions.

Given the broader and longer-term implications of the court’s decision, the government has once again decided to suspend the debt brake, effectively freezing all new savings permissions for 2023.

The funding plan for the following year, which was scheduled to be presented to parliament next week but has been indefinitely postponed, has not yet been addressed. If the government takes any steps to overhaul the special funds, it could face further legal challenges.

Lindner noted, “Once we have a situation that is legally protected and constitutionally sound, we can simply discuss 2024 and the following years again. New legal precision has emerged regarding how we must deal with specific property.”

According to Bloomberg Economics, “The outlook for the nation’s governmental plan has become much more uncertain. Several economic and infrastructure projects may not be immediately funded. The gradual recovery from the downturn in 2023 may be jeopardized, and our 2024 estimates may face significant downside risks. This could lower GDP growth by 0.5% the following year.”

Borrowing restrictions are enshrined in Germany’s constitution but can be partially lifted in the case of emergencies or natural disasters beyond the government’s control.

They were suspended for three consecutive years through 2022 to address the fallout from the Covid-19 crisis and the rise in energy costs resulting from Russia’s invasion of Ukraine.

While there hasn’t been much market reaction to the court’s decision thus far, it could have positive long-term implications, given the potential for reduced issuance next year.

Structural net borrowing, adjusted for seasonal factors, is limited to 0.35% of gross domestic product under the debt brake rules. During an economic downturn, increased online borrowing is permitted, but there is less room for additional debt during an upswing.