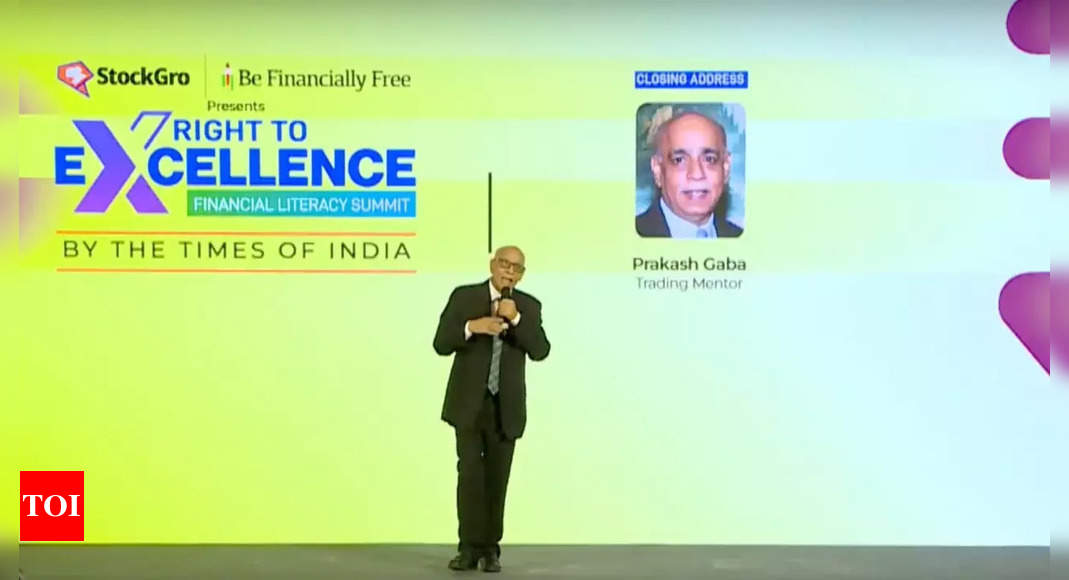

At The Times of India Right to Excellence Financial Literacy Summit, Prakash Gaba, Trading Mentor & Advisor spoke extensively on trading strategies for the stock market, his learnings as an investor and how emotions play a key role in deciding whether we make profit or incur a loss.

Prakash Gaba spoke of his humble beginnings. “My beginnings have been real poverty, absolute poverty,” he said.Gaba detailed his life story, how he was weak in studies but eventually went on to do management and secured a job. “My father by then had progressed in life and he had become rich, he had shops of textiles,” he said. “My dad asked me to leave my job. He told me as long as you’re good, bosses will keep you on their head. They’ll pamper you. The day they don’t need you, you’ll be fired. I left Delhi, joined the family business, progressed and expanded the business and made crores of rupees,” he added.

Talking about the stock market, Gaba said, “Everyone who makes money in the stock market brags that he has made money. But anyone who loses money will never speak about it.” He also said that when it comes to stock market intelligence stops working. Because then you’re playing with emotions. He spoke of his experience in investing and making money from stocks and regretting profit booking.

Gaba said that eventually he just kept pumping money into stocks. “I started losing money. I was comfortable losing money, and that is why I started losing more money. Now that comfort is the biggest risk problem that you have,” he said, adding that his losses reached a level where he didn’t have money to buy medicines for himself.

Gaba said, “If I have lost money, then there is someone who has made money. If that someone can make money, why can’t I? That is the only day that I made a decision to make money. Wanting to make money is different, but the decision to make money is required.”

Importantly, Gaba said that the profit is not in your hands, the loss is. “As long as you can control the losses you’re in the game. And the longer you are in the game, you will make money.”

The trading mentor spoke of his journey to understanding charts and stock markets. He explained how he got in touch with a charting expert in the US, who agreed to teach him if Gaba travels to the US and pays a fee. Gaba’s wife made money by selling sweets and that helped him fund his trip to the US. Gaba listed the mantras he learnt from the expert:

- Trade what you see, not what you think

- Trade the markets, not the forecast.

- Your forecast is your opinion, it has nothing to do with the markets

- Trading is only about making money

He added, “The market doesn’t do what you wanted to be done, it will do what it wants to do.” “As long as you’re willing to lose little and make more money, you’re in the game. I never forecast the market, I trade markets,” he said.

“The problem is that we don’t want to lose in a trade. We want every trade to work out right. That is nonsense. A person who’s willing to lose money in the stock market is actually a winner in the stock market. And the person who’s not willing to lose money in the stock market is a loser in the stock market. Willingness to lose, but loose little. That’s the trick,” he said.