Cultivating Financial Savvy from High School

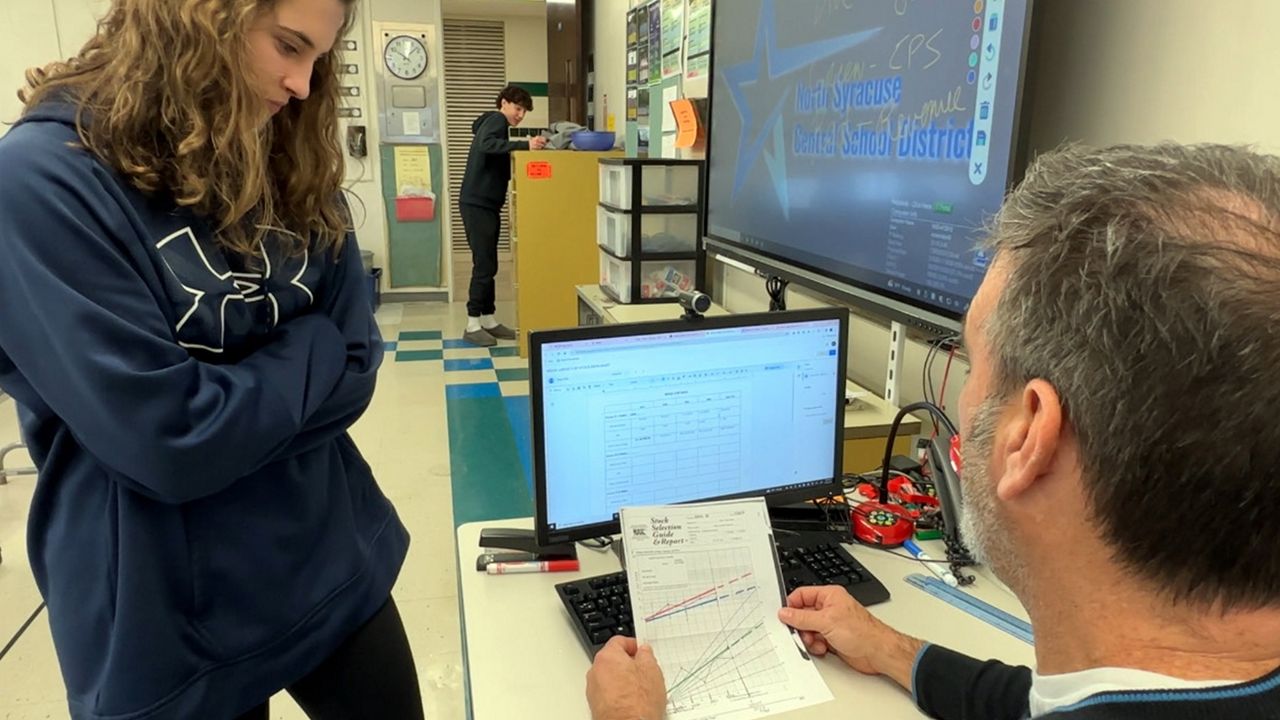

Imagine if, before stepping into adulthood, everyone learned the essentials of investing and budgeting. At Cicero-North Syracuse High School in New York, Rick Mancabelli, a business education teacher, has been turning this idea into reality for years with a course that mirrors real-world Wall Street strategies. He teaches students to create realistic budgets based on their career aspirations, helping them identify what he calls “opportunity capital” – funds they can afford to invest.

Real-life Financial Lessons Impact Students’ Futures

Lucas Thelen, a student from Mancabelli’s class, used his newfound knowledge to save diligently and purchase a car outright, avoiding the burden of monthly payments. This practical application of his lessons in savings and investments has set a solid foundation for his financial future. Meanwhile, his classmate Ella Cassel, who aspires to a medical career, has already started investing her earnings, choosing to put her money into Berkshire Hathaway based on its lower risk and solid returns, as learned in class.

A Broader Vision for Financial Education in Schools

Despite the success stories from Mancabelli’s classes, comprehensive financial education is not yet a standard part of the curriculum for all students in New York. Efforts to pass legislation requiring financial literacy courses in public schools have been made since 2009 but have yet to be enacted. Lucas Thelen, inspired by his own experiences, plans to become an elementary school teacher and integrate financial literacy into his teaching to help young students understand money management from an early age. This early education, he believes, is crucial to shaping financially savvy adults.