Introducing Financial Basics Early

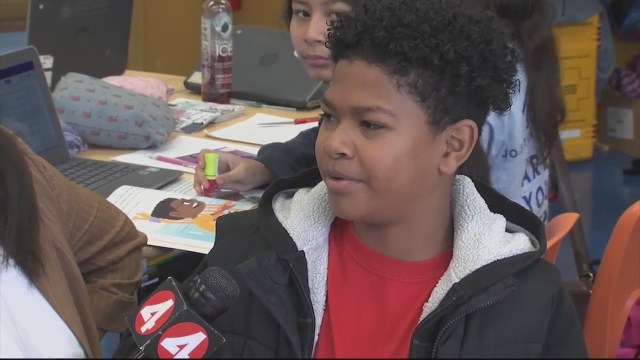

In Oakland’s Franklin Elementary School, young students are engaging in discussions about budgets, debit cards, and savings accounts, topics not usually associated with fourth and fifth graders. Educator Valerie Chapman, a former banker, is spearheading a program that introduces these young learners to financial concepts like investing, saving, and responsible budgeting early in their education. This initiative reflects a growing awareness of the importance of financial literacy from an early age, particularly in underserved communities.

A Practical Approach to Financial Education

Chapman’s program, Financial Literacy for Children, goes beyond theoretical knowledge by incorporating interactive components like the SIFMA National Stock Market Game, where students manage $100,000 in virtual funds to learn about investing. This hands-on approach has not only seen Franklin’s students win this game multiple times but has also helped demystify complex financial concepts for them. As they simulate investments in familiar companies like Walgreens, Walmart, and Amazon, they start to grasp the practical aspects of the financial world they interact with daily.

Broadening the Impact of Financial Knowledge

The success at Franklin Elementary has caught the attention of financial education advocates like Tim Ranzetta, co-founder of Nexgen Personal Finance, who has supported the school with resources. His broader goal is to see such programs adopted across California, recognizing the state’s potential to lead in financial education. The program aims not just to equip students with financial skills but also to involve their families, thereby extending its impact beyond the classroom and into the community. As these young students gain financial confidence, they’re also setting foundations for long-term economic stability and success.