By the time you reach age, in one way or another, money have probably found a way to stress you up.

And at this point you’re only looking for someone to sign Jerry Maguire, “Present me the cash!”

However, the Babson Financial Literacy Project wants to show you how to make the most of what you already have.

“This class, according to Megan Rivera, couldn’t have been held at a more appropriate time. especially at this time in my life when my husband and I want to purchase a bigger home. I want to begin a family, I want to travel”, Rivera told WBZ’s Courtney Cole.

Rivera, who is living with cancer, said she initially found out about the action through The Expect Miracles Foundation’s SAMFund.

“I lost my job. I lost my job. I was receiving health costs. But, I really needed that completely school, and I was really very thankful they were able to enable,” Rivera told WBZ.

The Babson Financial Literacy Project was founded out of a need to use their skills to help the area, according to Kathy Hevert, one of the co-founders of the system, and Robin Kahn, the program director.

We see ourselves as a little bit different from many other applications, they say. Our seminars are very interactive, and conversation based and we use small vignettes that are realistic to younger adults”, Kahn said.

“And it was so likeable. You know, I read books and had resources manager, but they asked a problem at the beginning of each program. For instance, who below has credit cards, and we would secretly solution,” Rivera explained.

Allowing individuals to experience in community, and never singled out.

The Babson Financial Literacy Project said they spend a lot of time with institutions, non- revenue, higher universities, and organizations.

“All of our supplies are written for people who have basic math skills: put subtract, divide, break. That’s all you need to be able to perform. Basic English and writing abilities, that’s it,” Hevert pointed out.

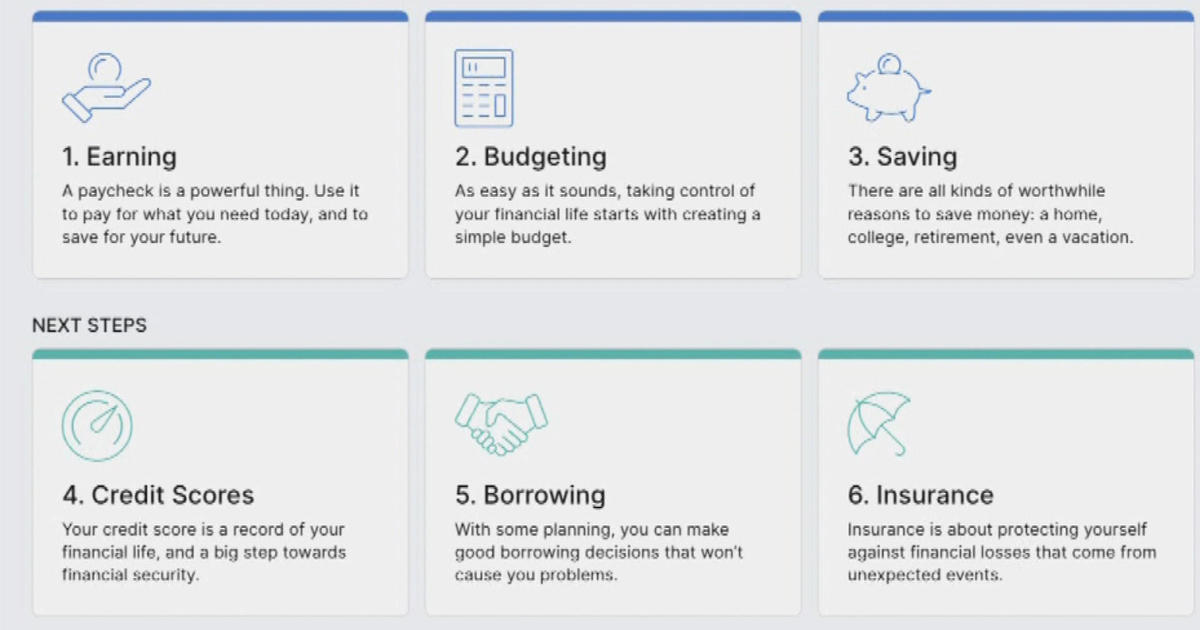

Some of their workshop topics include… but aren’t limited to:

- Creating the best life possible through cash management

- Understanding your salary

- Making student debts work for you

- Tips and methods for managing your payment

“We work really hard in our seminars to make people feel comfy… That it’s never too late to start saving. It’s never too late to start managing your finances”, Kahn said.

Since their first studio in 2018- the Babson Financial Literacy Project has led 320 sessions and had more than 14, 000 members.

“Without taking this course, I’m not sure if I would have used cash back bonuses, used credit cards, or perhaps understood how to generate passive income from my own income. So that was actually big,” Rivera told Cole.

Hevert and Kahn are beginning to collaborate with kids at HBCUs and Mass Bay Community College.

Additionally, it is important to mention that this group is completely!