Exploring Cognitive Ability and Financial Optimism

A recent study led by Chris Dawson, a cognitive economist from the University of Bath, reveals a compelling correlation between financial optimism and cognitive ability. Published in the Personality and Social Psychology Bulletin, Dawson’s research involves a thorough analysis of Americans’ financial expectations compared to their real-life economic outcomes. His findings suggest that individuals with higher levels of unrealistic financial optimism often possess lower cognitive abilities, potentially leading to poorer financial decision-making.

The Impact of Cognitive Skills on Financial Judgments

The study utilized data from two extensive surveys, the Understanding Society project in the UK and the American Household Panel Survey, which collectively spanned several decades. These surveys assessed participants’ financial status and expectations repeatedly, allowing Dawson to track changes and accuracy over time. Cognitive tests included in the surveys measured skills such as memory, language proficiency, and mathematical reasoning, which Dawson correlated with participants’ financial optimism.

Consequences of Unrealistic Optimism

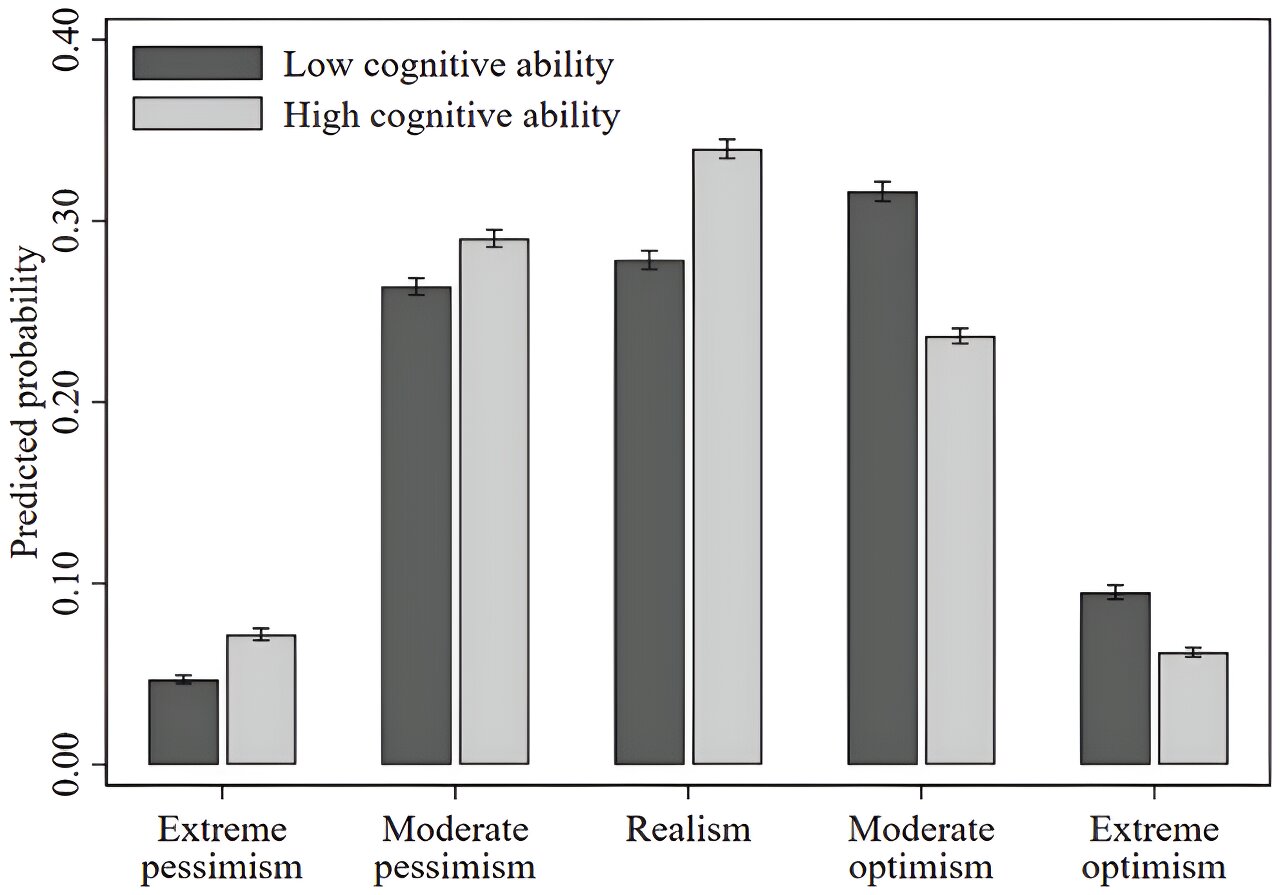

Dawson’s findings indicate that people with higher cognitive abilities tend to be more realistic about their financial prospects, while those with lower cognitive skills exhibit a more optimistic outlook without the basis in reality. This optimism, while potentially beneficial in boosting morale, can lead to significant misjudgments about financial decisions, such as insufficient savings for retirement. The study emphasizes the need for targeted financial education that considers cognitive abilities to help individuals make more informed financial decisions.

Chris Dawson’s work is a groundbreaking step in understanding the intersection of psychology and economics, illustrating how cognitive abilities can profoundly impact financial behavior and planning. His research is detailed in his paper, “Looking at the (B)Right Side of Life: Cognitive Ability and Miscalculated Financial Expectations,” which sheds light on the importance of fostering financial literacy alongside cognitive development to enhance both personal and societal economic outcomes.