The ₹1,201 crore initial public offering (IPO) was open for subscription from September 20 to September 22 with a price range of ₹210-222. The issue included a fresh share sale of ₹600 crore and an offer for sale (OFS) of up to 2.70 crore equity shares by its promoter group shareholders.

The issue was oversubscribed by 4.47 times. The allocation for qualified institutional bidders (QIBs) was oversubscribed 12.17 times, while the portion for non-institutional investors was oversubscribed 2.54 times. However, the quota reserved for retail investors saw only 91 percent of subscriptions.

The stock was listed on September 27, 2023, at ₹231 on the NSE, representing a 4 percent premium to the issue price. Since its listing, the stock has risen by over 29 percent.

Shortly after listing, the stock experienced some profit booking, but it showed a significant recovery in November. It has surged over 25 percent in November after a 5.6 percent decline in October.

The stock reached its record high of ₹302.40 in the previous session on November 24, 2023.

About the Firm

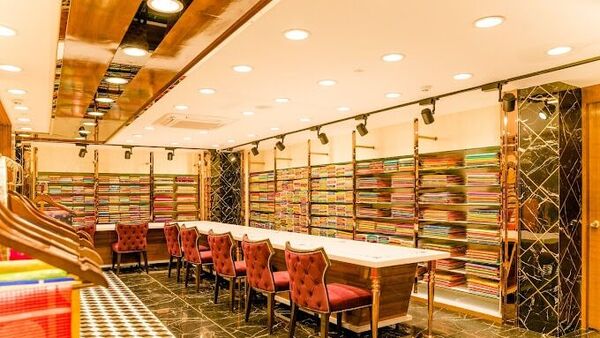

Established in FY05, Sai Silks (Kalamandir) Ltd (SSKL) is one of the largest apparel retailers in South India, offering a range of products in ethnic wear, predominantly sarees, and value fashion. The retailer operates four popular brands—Kalamandir, Kancheepuram Vara Mahalakshmi Silks, Mandir, and KLM Fashion Mall—covering various price points. Its cluster-based presence, spanning 54 stores and 6,02,414 sq. ft, across four southern states (Telangana, Karnataka, Andhra Pradesh, and Tamil Nadu) ensures superior operating efficiencies and unit economics.

Investment Rationale

1. Beneficiary of Unorganized to Organized Transition in Sarees: Historically, the retail saree trade was dominated by unorganized players in small-format stores. SSKL, along with other organized retailers, is addressing the need for consolidating SKUs/variety through large-format retailing. The saree market in South India is estimated at ₹26,200 crore (total saree market: ₹52,393 crore). With a 5 percent market share, SSKL is poised to benefit from this value migration as it caters to a broad consumer base at multiple price points.

2. SSKL as a Smart Scaler: SSKL has followed a disciplined scaling approach with a concentrated cluster-based expansion strategy. Despite the presence of over 150 south districts, SSKL operates in only 12 (with 54 stores spanning 6,03,414 sq. ft as of Mar-23). Such a dense presence improves brand recall, sales density, and retailing cost efficiency. SSKL enjoys high revenue per sq. ft (₹22k/sq. ft) and low retailing costs within the apparel retail segment.

3. Tamil Nadu Foray Holds Promise: The Tamil Nadu market, accounting for ₹7,400 crore and a 32 percent share in the South, has higher footfall density and consumer affinity for saree purchases. SSKL’s IPO proceeds are earmarked for expanding its presence in Tamil Nadu through VML. Since SSKL has a mere 1 percent share in Tamil Nadu, its entry via VML appears promising in terms of both growth and unit economics.

Financial Analysis:

- Revenue: SSKL has achieved a 17 percent revenue CAGR from FY16 to FY23. While much of the growth is driven by expansion, same-store sales growth (SSSG) has typically ranged from 2-4 percent. A 3 percent SSSG is sufficient to cover store-level cost inflation, given that store-level costs account for only 15 percent of sales, with central costs constituting the remaining 10 percent.

- Net Profit: Improved net profit (40 percent CAGR from FY23 to FY26) results from gross margin gains, stable retailing costs, and a reduction of ₹12-15 crore in interest expenses due to debt reduction from IPO proceeds and internal accruals. The brokerage projects ₹189/269 crore in PAT for FY25/26, respectively.

- EBITDA Margin (EBITDAM): EBITDA margin expanded by 562/449 bps from FY20 to FY23 due to premiumizing offerings, consistent price hikes, and an increased skew of higher EBITDAM format VML. Gross margin increased from 31.5 percent to 39.1 percent during FY20-23.

With the predominant vehicle for expansion being VML, EBITDAM expansion is expected from higher sales density and lower advertising and business promotion expenses. SSKL plans to improve sourcing margins by offering better terms of trade to weavers, further enhancing gross margins. The brokerage estimates a 267/280 bps EBITDAM expansion from FY23 to FY26.

Track Record and Expectations

SSKL has demonstrated growth resilience and product affinity, nearly fully recovering from the pandemic by FY22. In FY23, it continued to perform well, with revenue growing by 19 percent YoY to ₹1352 crore. EBITDAM also expanded from 9.3 percent in FY20 to 13.7 percent in FY23. Return on capital employed (RoCE) and return on equity (RoE) improved from 17 percent/20 percent in FY20 to 19 percent/27 percent in FY23, respectively. The brokerage forecasts a 19 percent revenue CAGR for FY23-26.

Key Risks:

- High concentration in a single product category (saree).

- SKU management challenges, as sarees are high SKU/store products.

- Increased competition from e-commerce platforms.

Disclaimer: The views and recommendations mentioned above are those of individual analysts or broking companies and do not represent the views of Mint. It is advisable for investors to consult certified experts before making any investment decisions.