Enhancing Financial Literacy in Hamilton County Schools

The National Financial Educators Council highlights that the typical American spends over $1,800 each year on credit card interest and fees. In response, Hamilton County has rolled out a comprehensive financial literacy program for students, aiming to provide them with vital money management skills. This initiative is set to be one of the most significant educational experiences students will have during their school years.

Revolutionizing Financial Education

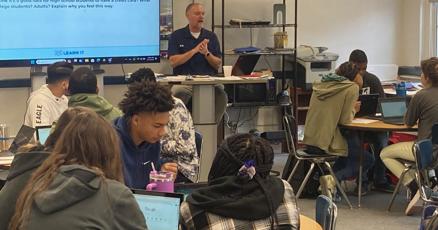

Many high school students often find their curriculum lacking in personal finance education, focusing instead on subjects like math and writing. Brandon Lowry, a teacher at Chattanooga School for Arts and Sciences, is determined to change this by offering a personal finance course. Lowry believes that this class, which covers essential topics such as income, insurance, loans, credit cards, and investments, could be the most important course for many students.

Expanding Financial Literacy Nationwide

Tennessee is among 35 states that have made financial education a priority, a significant increase from just seven states a decade ago. This change reflects a growing awareness of the importance of financial literacy. Students like Jordan French and Lucie Gentry recognize the value of this course, especially as they prepare for adulthood and real-world financial decisions.

Practical Financial Knowledge

The course aims to equip students with practical financial skills that will benefit them throughout their lives. Chris Hopkins, a financial advisor who played a key role in introducing the Next Gen Personal Finance course in Hamilton County, underscores the importance of early financial education. Hopkins and other experts believe that understanding personal finance can help young adults avoid common financial pitfalls.

Key Financial Principles for Students

Before graduating, students should understand several essential financial principles:

- Start Investing Early: Early investments grow significantly over time.

- Pay Credit Card Bills in Full: Avoid interest and late fees by paying off credit card balances monthly.

- Make Saving a Priority: Cultivating a saving habit is crucial, even if it doesn’t seem immediately necessary.

- Create and Stick to a Budget: A budget can greatly enhance financial stability.

Starting this fall, all high schools in Georgia and Alabama will also adopt this updated financial literacy curriculum, joining Tennessee. North Carolina currently leads the nation in high school financial education standards, highlighting a broader effort to prepare students for financial independence.