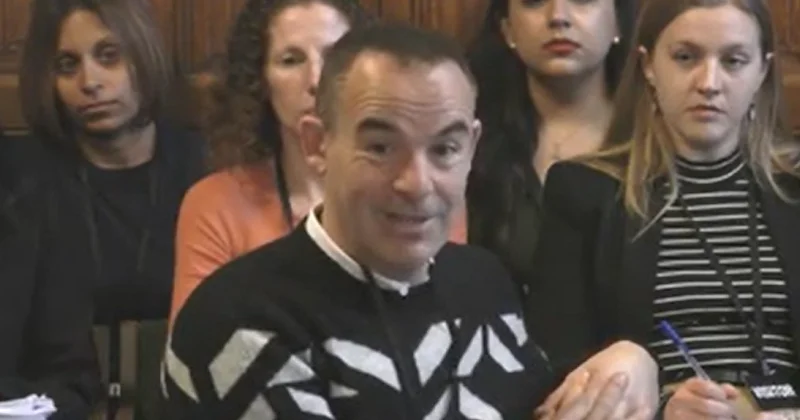

The Money Saving Expert creator also revealed to MPs that his organization paid more than £500,000 for the publication of a textbook on economic mathematics after former state secretary Nick Gibb told him the state may not pay for it, he referred to as a “political failing.”

In 2014, the national education expanded to include more financial literacy topics, mainly in math. One of the main campaigners for the shift was Lewis.

However, he claimed it was “in many ways …a decisive success” after being quizzed by the Parliamentary Education Committee this day.

“In some ways, it was counter-productive. To go into schools and teach economic learning, you had charity organizations and other people funding and providing support there.”

It was included in the federal education in England. And at that level, a lot of the solutions were taken from the private business and those who had been volunteering.

The development of schools, which do not have to follow the regional education, made this even worse, he added.

So the sacred blood of trying to get it taught in every class on a mandatory base, which is what getting it on the education was all about, became self-destructive.

Not sure if we changed the game.

Lewis also warned that the government’s investment in the subject had been “totally inadequate and to a damaging level.”

I’m not sure if the campaign really changed the game in any way, even though I can’t say that I regret winning it at the time.

He issued a warning about “real poverty of economic schooling” throughout the UK.

Due to “a lack of resourcing for institutions, a lack of funding for teacher education, and a lack of attention being put on this, but superintendents who are already under extend have the ability and the desire to prioritize and make sure that this is being done”

Lewis cited the £40 billion that was refunded to survivors of the payment protection insurance mis-selling incident.

“We would completely revolutionize everything we have ever done if we put 0.1 percent of the money that was mis-sold on payment protection insurance into financial education, which would be worth $40 million.”

“And perhaps if we put the £40 million in, we wouldn’t have the £40 billion mis-selling scandal in the first place. It’s about being unified as a community.”

Government refused to pay for textbooks

Your Income Matters, a text on economic mathematics, was published by Lewis and Young Money in 2021, and it has since been provided for free to all secondary schools in England.

After Gibb, then the schools secretary, told him a text was needed but the condition may not pay, Lewis revealed nowadays that he had used more than £500,000 of the money for the source.

Lewis argued in “large political opposition” that a personal person may be required to pay for a text in all public schools.

Why did Martin Lewis contribute to the funding of a textbook on economic mathematics?

However, after being told “quite briefly that it would not happen unless I funded it,” he “found it over my own concerns.”

According to Lewis, Lewis added that the government even refused to support the publication if it was published through a publisher, but “we really had to fund the printing and the printing.”

“We essentially had to self-publish. We couldn’t get the DfE to write the letter it did to schools that supported the textbook if we didn’t self publish.” Now, pardon me, what a terrible farce. Is n’t that just absurd, then?

I had had added bias to the curriculum, I thought.

Lewis did not exercise editor command over himself. However, he noted that a private person who was providing the project “could have used it as a piece of propaganda [which] doesn’t seem right to me].”

At the conclusion of the hearing, Lewis addressed minister Adam Brown, saying: “I funded this textbook because the state wouldn’t and that it had to be funded by an individual.”

That is a mistake in politics. This text might have been biased in some ways. We require proper training for teachers, online sources, and textbooks.

Hinds said he was “material with where we are on the math curriculum” when asked about the state of financial education.

However, he continued, “I do believe there is another chance to simplify the process of a teacher finding the best materials to support some of these areas of teaching.”

He praised the “diversity” of tools available on the subject and claimed Oak National Academy was being funded by the government.

He argued, however, that the Oak lessons did not “represent a standardized approach because it isn’t required.”

Hinds added that he would not “rule out” England’s involvement in the PISA international financial education test, which the nation does not already provide to lessen the “burden” on schools.