High school juniors, seniors and families stress over college costs. A new software, SECURE 2.0, encourages earlier saving for education and retirement with 529 benefits.

Every state has an accounts, according to Chris McGee, Chair of the College Savings Foundation, and you can just open one to invest money in it.

“When you take it out and use it for stuff like tuition, fees, books, computers it remains taxes- completely. Therefore, it significantly aids in saving for these educational targets.”

Individuals can learn about the choices they have to set up their children for a lifetime through the renowned nonprofit College Savings Foundation, CSF.

“It’s never too soon and it’s never too quick. The great thing about 529s is that you can also save money for things after school.”

Beginning on January 1, 2024, the SECURE 2.0 system will allow people to transfer 529-related school savings to a Roth IRA.

“We can also assist families jump-start their son’s retirement savings because we think it’s never too early to start saving for both learning and retirement,” said McGee.

They let your child avoid having to rely so heavily on student loans, and they let you keep shortly and frequently for their college savings. In truth, the ultimate goal is to never have student loans.

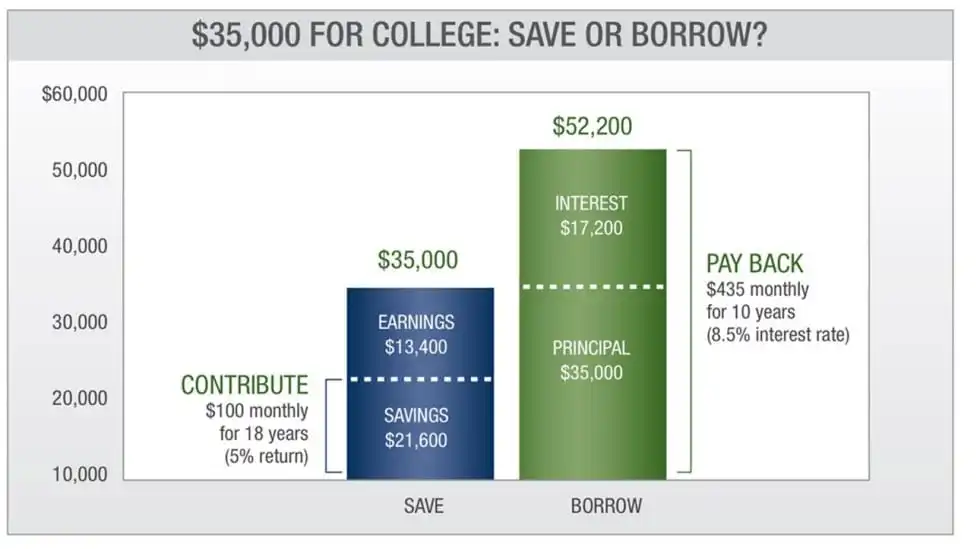

MeGee explains the distinction between putting money away on 529s and getting a mortgage.

For example, saving $100 every month for 18 years accumulates to $35, 000. In contrast, borrowing $35, 000 results in a settlement totaling $52, 000 over a century.

“It’s not necessary to keep every last coin for learning, its an expensive proposition, but it helps greatly to save and had some money.”

According to the Department of Labor, the typical American will change jobs between five and seven times during their working lives, and 30% of that time may change.

“Each of those job changes will need training, and 529s does assist with that knowledge and career training,” said McGee.

According to a CSF survey of parents, 46% of them said they would require more training or accreditation for their own careers.

You can use your benefits at any of the following organizations if you enroll in one of the qualified educational institutions, which are essentially any organization that accepts national funding or is a participant in the federal loan program.

McGee also makes note of the value of imparting financial literacy to your kids.

“I suggest that you check out a number of excellent online programs that will give your children a solid foundation in economic literacy.”

Financial education refers to the knowledge and abilities that enable people to make sound financial decisions.

This can be through training about budget, saving, investing, record and retirement.

“I think being a family and having to have those meetings, they are ideal to have around the dinner board,” said McGee. Let your kids see how you pay bills, and letting them know that you have responsibilities and how you make cash to fulfill those obligations.

You can always study and understand more at CSF, Georgia’s 529 system including your local dealer.

The transactions are available, the information is accessible, and we wish everyone the best success saving for school.