Exploring Robinhood’s Features

In an ever-changing economic environment, investment options can be increasingly complex, making personal finance management more challenging. Celebrating its 10th anniversary, Robinhood is revolutionizing the investment experience with its user-friendly platform that simplifies financial management. By offering a commission-free system and a wealth of resources, Robinhood democratizes investing for a new generation of investors.

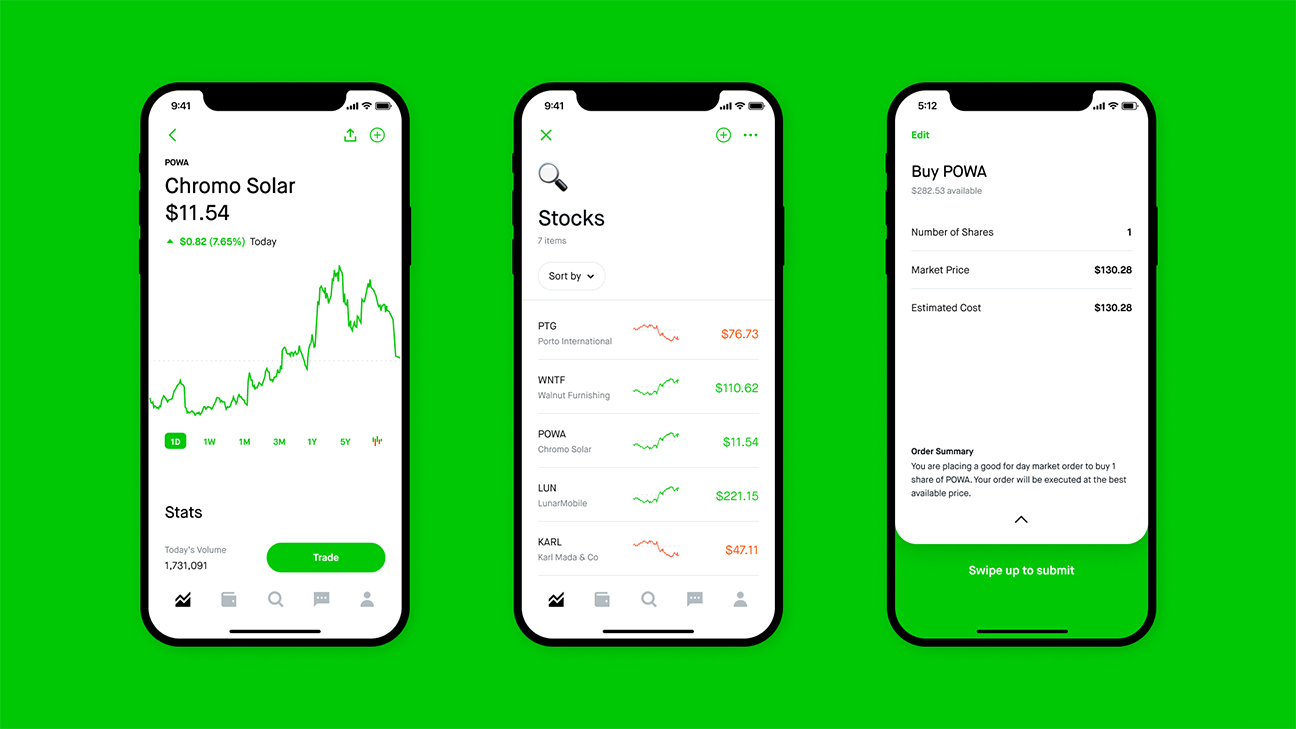

Commission-Free Trading Around the Clock

Robinhood makes it easy to buy and sell stocks, ETFs, options, and cryptocurrencies without paying commissions. The platform’s intuitive design allows users to manage their portfolios, track market trends, and execute trades from their mobile devices or desktops. As the only U.S. brokerage offering 24/5 trading of individual stocks, Robinhood enables investors to react to market news in real time, ensuring they can adjust their portfolios based on current market conditions.

Comprehensive Educational Resources

Staying informed about the latest investment trends and news is crucial for successful investing. Robinhood provides a variety of educational materials, including articles, tutorials, and investment guides covering topics such as stock trading basics, investment strategies, and financial planning. Additionally, the platform offers timely news updates, market data, analysis reports, earnings calendars, and analyst ratings to help users stay well-informed.

Advanced Trading Options for Experienced Investors

Robinhood Gold, the platform’s premium membership, offers enhanced features for seasoned investors. Benefits include 5.0% interest on uninvested cash and access to powerful investment tools. For a small monthly fee, users can leverage these advantages to refine their trading strategies and maximize returns.

Simplified Retirement Planning

Robinhood makes retirement planning accessible, especially for those without employer-sponsored plans. The platform offers the first IRA with a 1% match, allowing users to invest in their future while receiving additional funds through the matching program. This innovative feature ensures that everyone, including gig economy workers, can save for retirement effectively.

Investing with Fractional Shares

Robinhood allows users to invest in fractional shares of stocks and ETFs, making it possible to diversify portfolios with smaller amounts of money. For as little as $1, investors can buy fractions of high-priced assets, spreading their investments across a range of securities to manage risk effectively. This feature is ideal for building a resilient and diversified investment portfolio on any budget.

Robust Security Measures

Robinhood prioritizes the security of its users’ accounts and personal information. The platform employs industry-standard security protocols, such as encryption and two-factor authentication, to protect user data and prevent unauthorized access.

Disclosures

*As of Nov. 2nd, 2023 via Bankrate.

All investments carry risk, including the potential loss of principal. Robinhood Financial LLC offers premium services through Robinhood Gold. The Brokerage Cash Sweep Program is a new feature of the Robinhood Financial LLC brokerage account. Interest is earned on uninvested cash withdrawn from your brokerage account. Program banks pay interest on the swept cash, less any fees incurred by Robinhood. As of March 15, 2024, the Annual Percentage Yield (APY) for Robinhood Gold members is 5.00%. The APY may change at the discretion of the program banks and the fees Robinhood receives may vary.

Terms apply to the boosted rate promotion. For more details, view our terms.

To contribute to an IRA, you must have wage income. The funds used to earn the match must remain in the account for at least five contributions, and early withdrawals before age 59 1/2 may incur penalties. Consult a tax advisor for questions, as Robinhood does not offer tax advice.

Trades in stocks, ETFs, and options at Robinhood Financial LLC are commission-free. Other fees may apply. See Robinhood Financial’s Fee Schedule for more information. Fractional shares outside of Robinhood are illiquid and non-transferable. Fractional share orders are not available for all securities. Extended hours trading involves additional risks. Diversification does not ensure profit or protection against loss. For more details, view our Extended Hours Trading Disclosure.

Robinhood Financial LLC and Robinhood Securities, LLC are registered broker-dealers and subsidiaries of Robinhood Markets, Inc.