Criteria for Personal Finance, by State

What happens if you give$ 50 to 600 kindergarteners to put toward college savings?

Through a individual finance plan that covered financial matters and urged people to save for school, low-income learners in San Francisco were given$ 50 in 2011. The starting compromise was 28 days the average stability by 2023, or$ 1, 422.

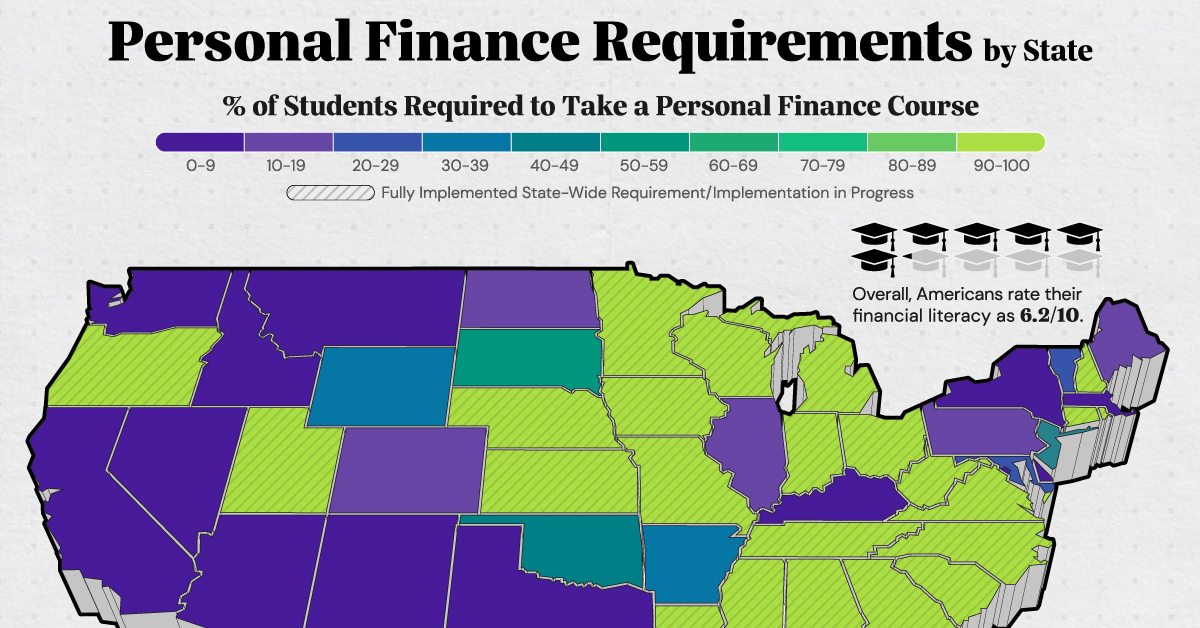

It emphasizes the importance of financial knowledge and how it can affect a person’s future given rising college costs and lower economic literacy rates in the United States. Based on information from Next Gen Personal Finance, the aforementioned visual depicts the state-by-state requirements for personal finance courses in December 2023.

How Some Kids Attend a Course in Personal Finance?

Private financing programs were a small component of American high schools for many years.

Even though these courses were available, schools frequently had to choose where to spend their school day.

Utah was n’t the first state to require high school students to take a personal finance course in order to graduate until 2008. Six says made this a prerequisite by 2019. As of this year, it has increased to 24 state.

The percentage of high school students who may enroll in a personal finance course over the course of one quarter to graduate is displayed below, broken down by condition:

| Position of the United States | What Percentage of Students Must Get a Private Finance Course |

|---|---|

| Alabama | 100% |

| Alaska | 1% |

| Arizona | 1% |

| Arkansas | 30% |

| California | 1% |

| Colorado | 13% |

| Connecticut | 100% |

| Delaware | 6% |

| Florida | 100% |

| Georgia | 100% |

| Hawaii | 0% |

| Idaho | 2% |

| Illinois | 14% |

| Indiana | 100% |

| Iowa | 97% |

| Kansas | 100% |

| Kentucky | 4% |

| Louisiana | 100% |

| Maine | 16% |

| Maryland | 27% |

| Massachusetts | 6% |

| Michigan | 100% |

| Minnesota | 100% |

| Mississippi | 99% |

| Missouri | 100% |

| Montana | 8% |

| Nebraska | 100% |

| Nevada | 3% |

| the state of New Hampshire | 100% |

| New Jersey, | 45% |

| Mexico’s New Mexico | 1% |

| New York, | 3% |

| Carolina, North | 95% |

| Dakota, North | 12% |

| Ohio | 100% |

| Oklahoma | 43% |

| Oregon | 100% |

| Pennsylvania | 17% |

| Island of Rhode | 100% |

| the South Carolina | 100% |

| in South Dakota | 57% |

| Tennessee | 100% |

| Texas | 3% |

| Utah | 100% |

| Vermont | 29% |

| Virginia | 100% |

| Washington | 2% |

| Washington, D.C. | 0% |

| Virginia’s West | 100% |

| Wisconsin | 100% |

| Wyoming | 33% |

Fully implemented states include Alabama, Iowa, Mississippi, Missouri, Carolina, North, Tennessee, Utah, Virginia. States where implementation is in progress include Florida, Georgia, Kansas, Michigan, Nebraska, the state of New Hampshire, Ohio, Island of Rhode, the South Carolina, Oregon, Louisiana, Indiana, Virginia’s West, Connecticut, Minnesota, Wisconsin.

As of December, Wisconsin was the most current position to put this condition into effect. 16 courses are currently in development, and eight states have completely implemented applications for high school students to acquire a personal finance course for completion.

Where Do Americans Stand in Today’s Financial Literacy?

According to their understanding of inflation, mathematics, compound interest, and risk diversification, almost six out of ten Americans are financially educated.

Over a third of respondents did not talk about money with their kids as they grew up, and many Americans do not feel financially ready for the future.

We can see that there are financial information gaps, which can have repercussions, particularly for a child’s future financial stability. Expanding economic knowledge may be one way to promote wiser financial choices in terms of how people save and invest over the course of their lives for a variety of reasons.