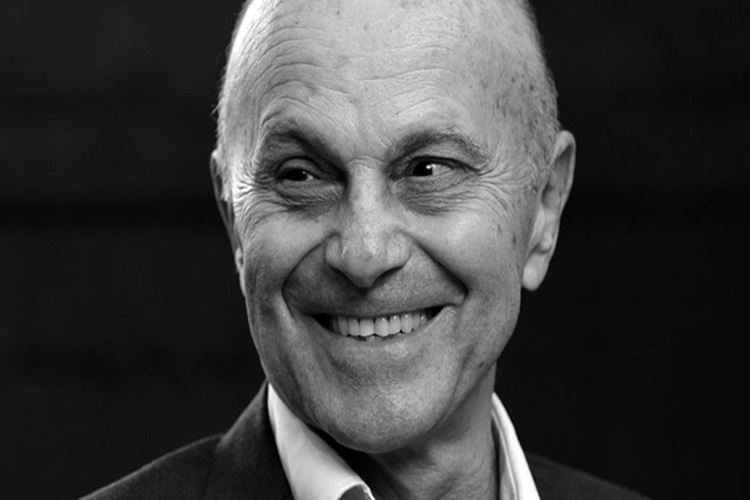

A well-known British economist, Eugene Fama is best known for his contributions to economic economics.

Career and Life

On February 14, 1939, Eugene Fama was born in Boston, Massachusetts. In 1960, Eugene Fama graduated from Tufts University with a bachelor’s degree in love languages. Afterward, he pursued a Ph.D. and an MBA in business administration. University of Chicago degree in finance, earned in 1964. His intellectual career served as the basis for his future financial contributions.

Fama started his intellectual career at Booth School of Business at the University of Chicago, where he remained for the majority of his time. The Robert R. McCormick Distinguished Service Professor of Finance is one of the roles he has held. The efficient market hypothesis (EMH), which states that financial markets incorporate and reflect all pertinent information, has been the focus of Fama’s research. The knowledge of stock prices and investment techniques has been significantly impacted by his ground-breaking research on EMH.

The Three-Factor Model, which extended the Capital Asset Pricing Model (CAPM) by incorporating additional factors —size and value—to explain stock returns, was created by Fama and Kenneth French. Asset prices and portfolio management now rely heavily on this model.

Eugene Fama has received numerous honors for his work, including the 2013 Sveriges Riksbank Prize in Economic Sciences in Alfred Nobel’s Honor. He is regarded as one of the most important economists in the field of financial finance, and his work has influenced the syllabus of financing programs all over the world.

Legacy and Award

For their experimental evaluation of asset costs, Fama, Lars Peter Hansen, and Robert J. Shiller shared the 2013 Nobel Prize in Economic Sciences.

The research on EMH by Fama has had a long-lasting effect on our comprehension of economic industry. According to EMH, commodity prices accurately reflect all information, making it challenging for investors to consistently outperform market schedule or stock picking.

The Three-Factor Model, which expanded the Capital Asset Pricing Model (CAPM), was created by Fama and Kenneth French. To better explain investment returns and give a more nuanced understanding of asset prices, the model added dimension and worth factors.

Fama is renowned for his meticulous empirical research, which has influenced the studies methodology and standards in monetary economics. His work served as an impetus for later generations of academics to test and improve financial theories using factual data.

The concepts and study of Fama are now essential components of finance curricula at universities all over the world. A key idea in the study of economic markets and assets is the successful market assumption.

Purchase strategies and investment management procedures have been impacted by Fama’s study. When making choices in the financial markets, many institutions and investment experts take Fama’s advice into account.