85% of Americans, according to the Intuit Financial Education Survey released this month, live in the country. S. High school students express interest in learning more about monetary subjects while still in high school.

However, some youth in Ann Arbor are really volunteering to teach children who are much younger than higher school.

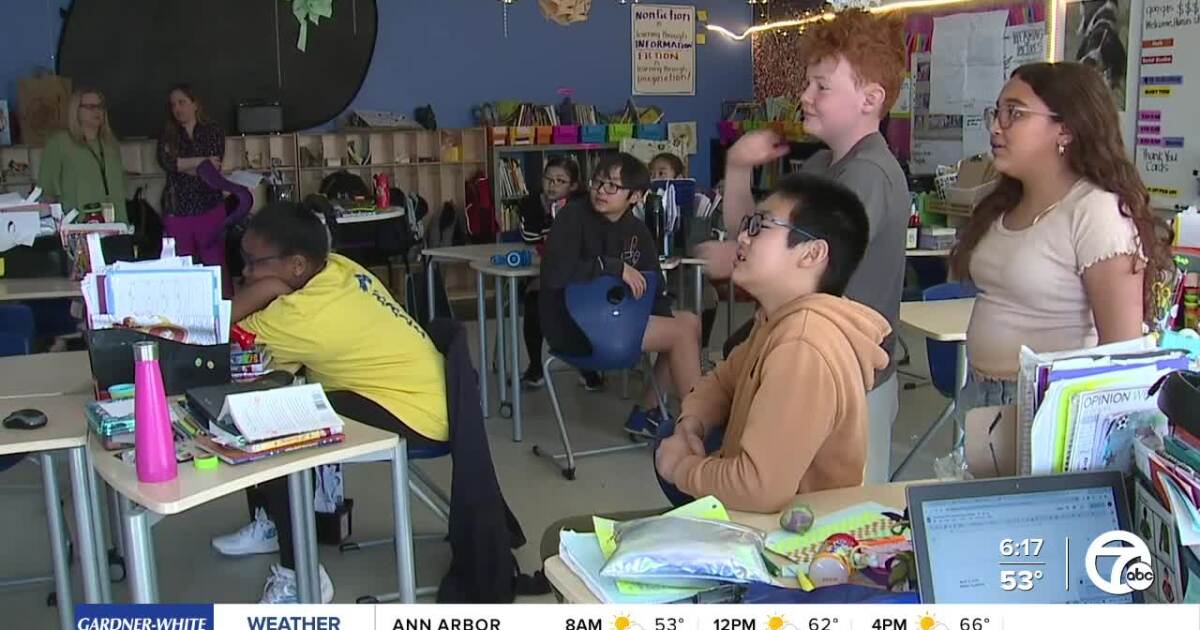

They stopped by a second grader’s secondary school this week to talk about money with them, and I want to let you know that they all had a lot to say.

The Huron High School “investment league” is a part of the inaugural National Teen Teach-In during National Financial Literacy Month. ”

“So, we are going to give you a demonstration about money and its price,” Caleb Patterson, a young at Huron High School, said.

They impart knowledge about saving to budget cases. The second grade at Thurston Elementary School in Ann Arbor were the recipients of their information. The boys actually engaged in a sport where they had to have on one side of the room if something was a “need” and remain on the other side if it was a “want.”

“Okay, it ’s not on the board, but ‘Going to the Gym’ – a ‘Gym membership,'” the students asked.

The majority of them ultimately came to the conclusion that paying for a gym account was a “want.” The discussion raged upon over TikTok and Fortnite.

”So, what do you people believe? Is this a requirement or a desire? ” Smrithi Arcot, a freshman, asked.

“Want,” the group responded.

But how about boots.

It largely depends on the shoe company. Trigger like Jordans– they’re cheap. But see the golf shoes like, like I have on, they’re not that cheap. But, they’re a want,” they said.

There were more mild light times.

“I didn’t know that credit cards you needed to give, give back for the times you used it,” Haku Nishioka, a fifth student, said.

Their adolescent professors were seeing the rewards.

“It was thus wonderful. I was very anxious right away. Like you are unsure of their level of tolerance. But like they were just but wonderful, they were thus participatory,” Smrithi said.

Caleb continued, “Only the value of money is so crucial to their potential because success depends on it,” adding Caleb.

The school’s business and finance teacher, Melissa Gordon, who presented the young teach-in concept, stated that the goal is to economically empower children.

Next Gen Personal Finance recently published a blog article discussing the differences between individuals who are exposed to monetary education in high school and those who are not. There’s a $100,000 difference in terms of their lives money,” Gordon said.

Her high school students were inspired to make the topic of wealth a wonderful experience, and they came away with a Jeopardy game.

One of the 130 high schools in 44 says that volunteered to sponsor the young teach-in events in April is Huron High School. The Jump $tar Coalition for Personal Finance Literacy is a part of a project.

Getting this, the top three items high school students wish they knew about their money, according to the study, are how to get rich, how to save money and how to avoid debts.