Recognizing the Gap in Financial Education

A recent survey highlights a critical gap in the UK education system: three-quarters of teachers believe that students leave school lacking essential financial skills. Conducted by YouGov for the Money and Pensions Service (MaPS), the survey involved 1,012 teachers and unveiled that a significant majority think financial education should begin well before secondary school. This early introduction is crucial for equipping children with the necessary skills to manage their finances effectively as adults.

The Current State of Financial Literacy Education

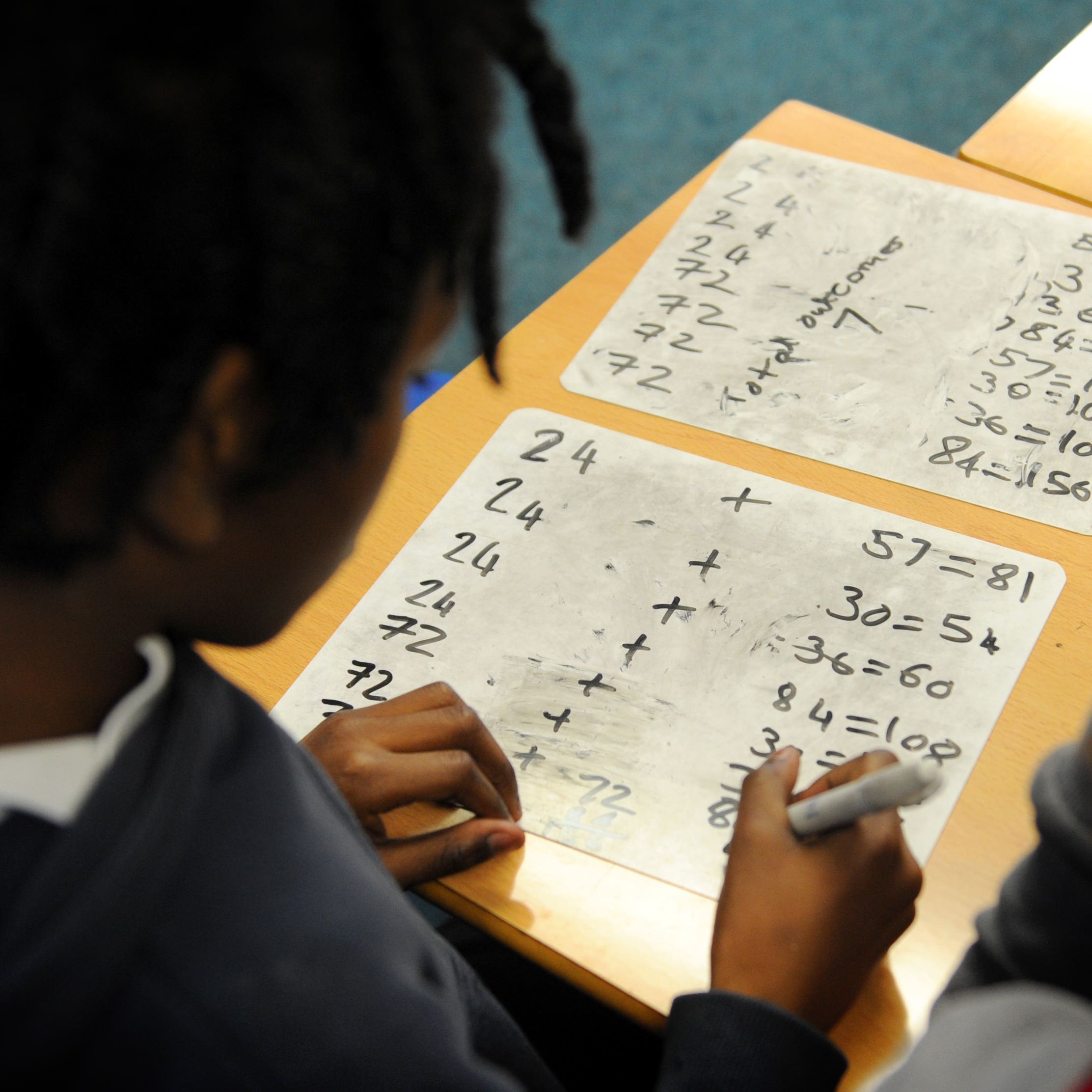

Despite financial literacy being part of the curriculum across the UK, integrated into subjects like maths and citizenship, the actual delivery and emphasis on these crucial skills vary significantly between schools. This inconsistency contributes to a large number of young individuals stepping into adulthood unprepared for financial responsibilities. The survey underscores an urgent call from educators and government bodies to prioritize and enhance financial education from an early age.

Challenges and Recommendations for Improvement

Teachers identify several challenges that prevent effective financial education, including the prioritization of other subjects, a lack of confidence among teaching staff, and insufficient resources. Additionally, the complexity of financial topics and a general disinterest among students further complicate teaching efforts. Educational leaders and policymakers are advocating for more comprehensive financial literacy programs within schools to prepare students better for the complexities of financial decision-making in adulthood. This improvement is essential for safeguarding the future financial wellbeing of the nation and ensuring that young people can navigate the world with the necessary knowledge and skills.