According to a study conducted by Capital One in 2023, over 40% of consumers lack basic knowledge and understanding of finance. And this has been a persistent problem in America for years: studies conducted in 2014 and 2017 found that both private finance and other areas share similarly low levels of understanding.

Manufacturers like Greenlight, Truist, and Zelle’s technician, Early Warning Services, have started gamified online encounters to encourage their customers to learn about personal finance in an effort to counter this.

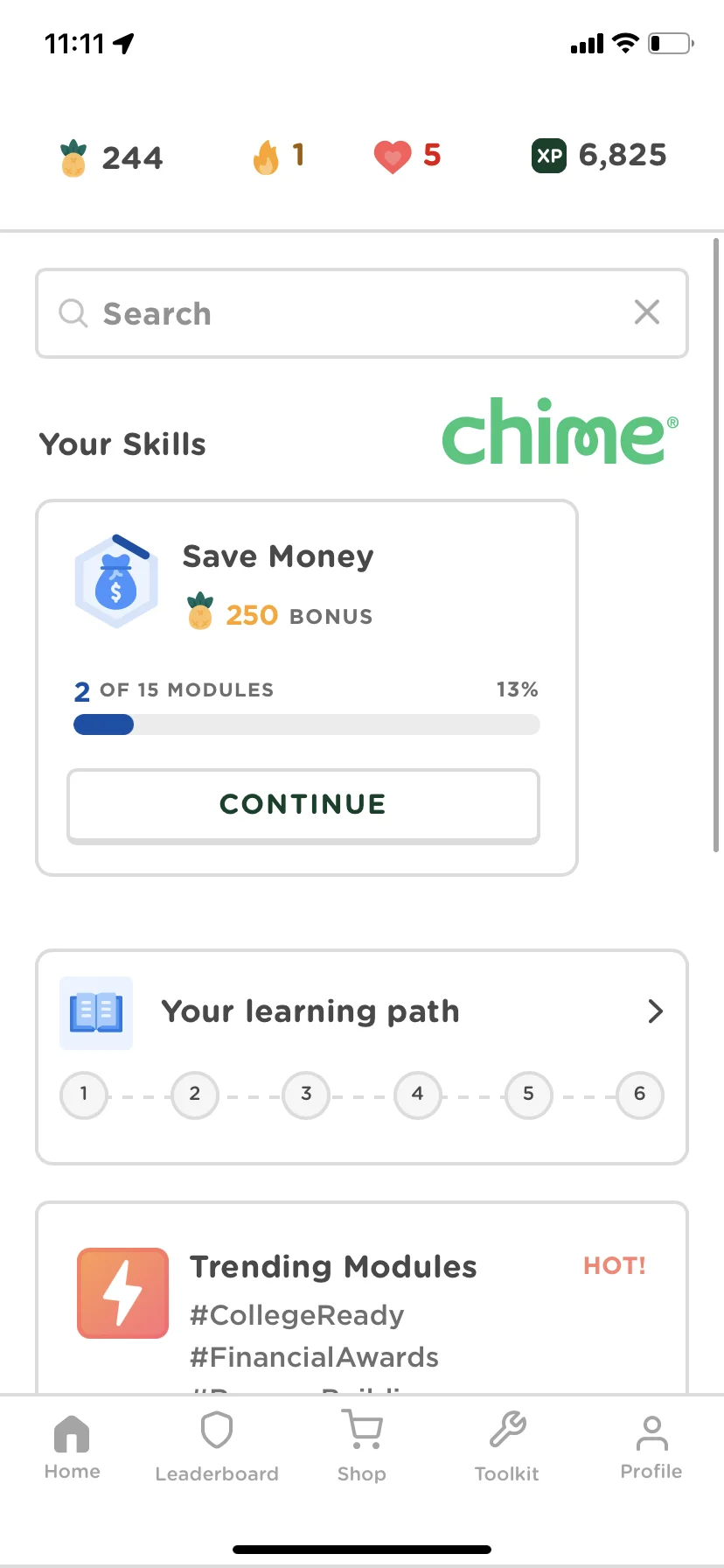

Neobank Chime just joined this list by forming a partnership with Zogo, a financial training platform that offers experiential training and quizzes that customers complete to earn rewards. Users of the relationship with Chime are given free access to the Zogo system and receive gift cards at retailers like Nike, Starbucks, and Amazon.

According to Sara El-Amine, Chime’s Vice President of Community, the companies worked for several weeks to create these lessons and include topics like funds, accounting, and savings. The topics covered by Zogo through the agreement also have a direct link to Chime’s MoneyMoves site, which provides in-depth data on finance, safety, and security.

“By giving them the tools and confidence to make informed decisions about their money, we anticipate that this relationship will have a major influence on our clients and their populations. Customers at Chime can even earn rewards for completing lessons that can be redeemed at their favorite stores, or they can choose to donate them to a charity of their decision,” El-Amine said.

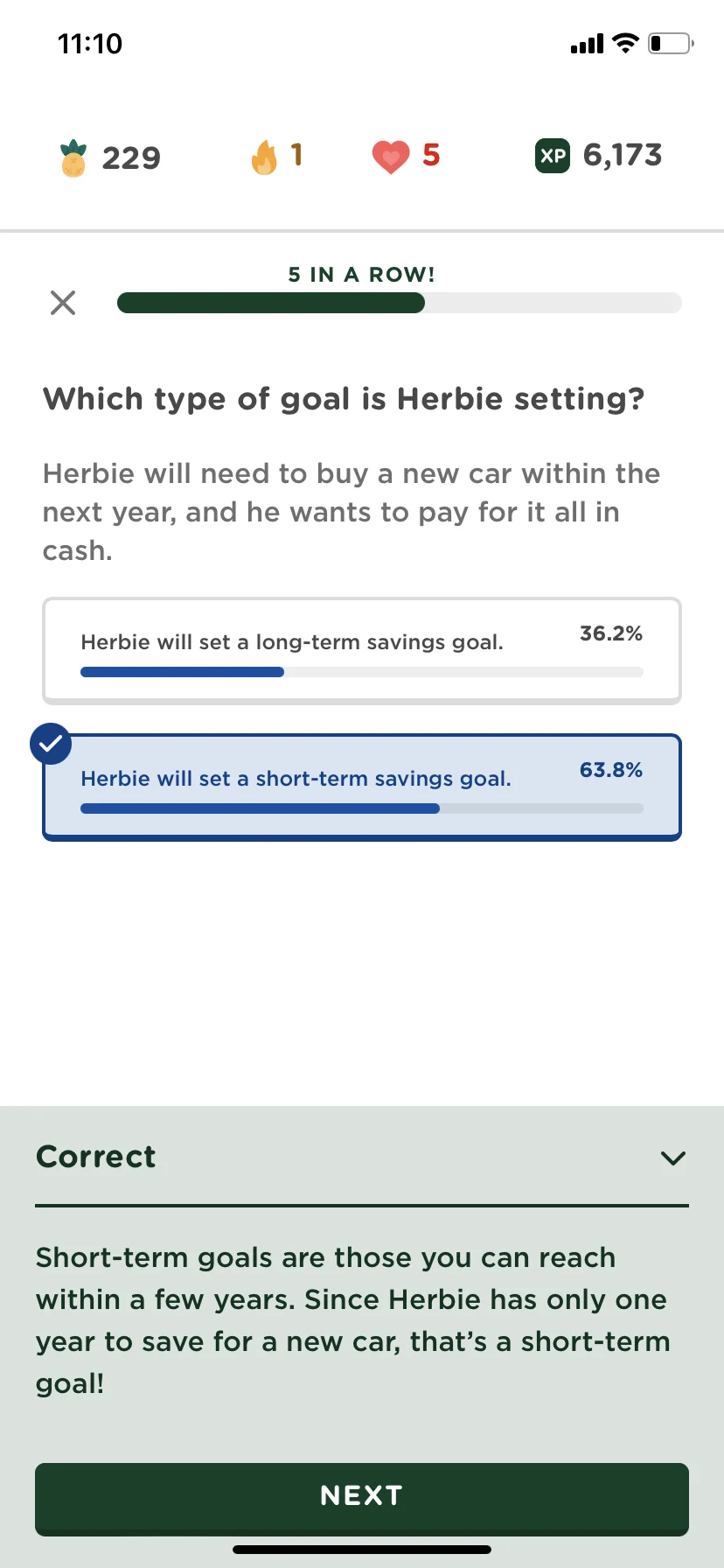

Similar to other learning-based software, the Zogo app’s user interface has a central home page that lists details about clients’ development, benefits, and details they earn along the way, as well as options for sub-categories of learning components. Following each package are questions that consumers can answer to improve their understanding of the topic.

There is a reason why so many financial institutions are turning to some form of gaming to raise engagement with educational materials, despite the platform’s use of experiential elements being fairly limited to a quiz-like structure and animations that play when you earn rewards.

Many studies have demonstrated that a game-like structure encourages learning and has a beneficial impact on user engagement and behavior change.

In a scroll-happy world where the advantage is non-tangible, most users are likely to scroll past these resources or never get them at all in the sea of content that platforms like TikTok create. For a while, FIs have been trying to persuade their customers to read their websites and educational materials.

This is why collaborations like Chime and Zogo use rewards like gift cards as the incentive instead of personalization.

“Gaming, in our opinion, plays a significant role in economic education by making the learning process enjoyable. People who are scrolling through their apps are where these classes are. Zogo makes the complex world of fiscal concepts more palatable and available in a way that feels natural to our people, which is why our focus is so in need these days,” El-Amine said. “This process encourages constant understanding of financial ideas, which improves financial literacy.”