At chairs facing the front of the school, two groups of four students are seated.

Their hands flutter close to the beepers as they wait for the following query to appear on the screen in front of them.

A variety of decision. Women and some minorities are occasionally prevented by an unspoken, unknown challenge, according to People’s State Bank employee Brandon Karaba. A student will buzz in with the right response before Brandon has even finished reading the question.

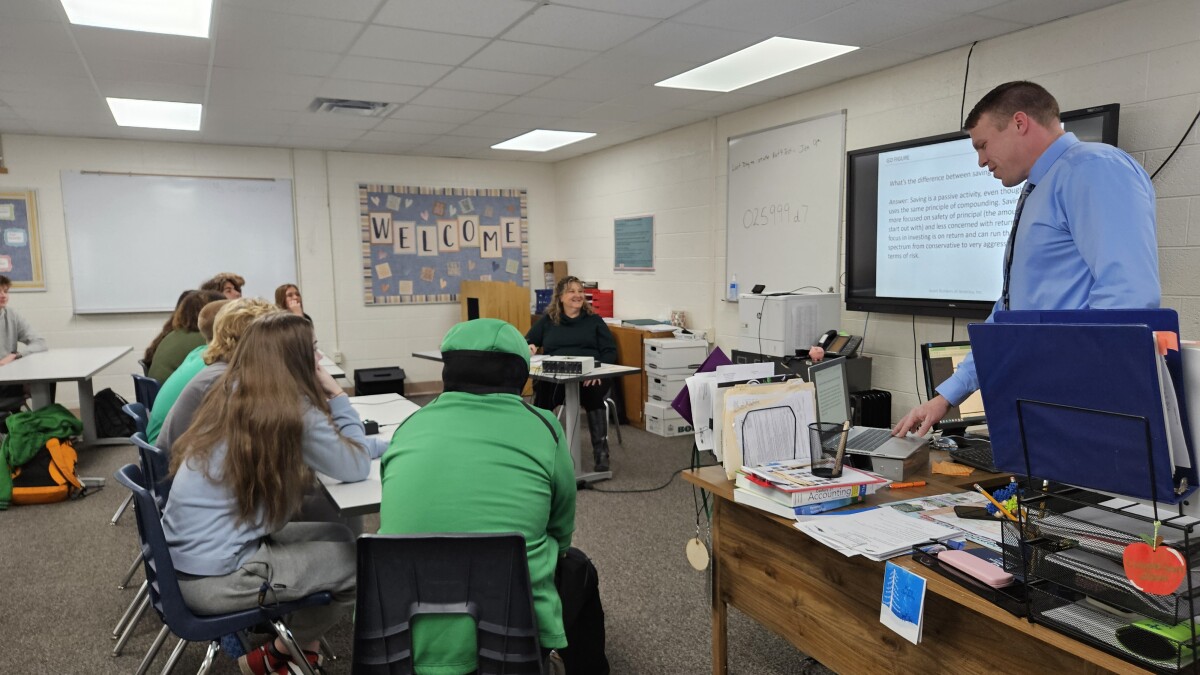

Anita Casperson’s school at Rhinelander High School is participating in a mock Finance and Investment Challenge Bowl [FICB] competition.

This week, some of them may take part in the Nicolet College Northwoods Regional Tournament. Before winter break, Karana paid a visit to the course to aid in their preparation.

The state finals in Madison will be attended by the best two teams.

For almost ten years, the School District of Rhinelander has sent at least one group to the state tournaments each month.

“It can be very aggressive, but it can also be a lot of fun.” I assist with the collegiate boys’ basketball team’s coaching. After the competitors past year, we had exercise with a few people who are on groups. They couldn’t discuss it enough. Karaba told the group, “It really is a fun environment, and it’s fun to do that.”

Patrick Kubeny, a recently retired professor, frequently oversaw the FICB groups. He contributed to the development of Rhinelander High School’s financial education programme, which included requiring students to take personal finance courses.

Every child must feed, after all. To live a healthier life, the child needs to exercise. They must be aware of their financial situation, Kubeny said.

Over the course of his 30 years in high school, Kubeny and the finance ministry were finally able to persuade the administrators and school board to mandate a course in money management.

Junior Payton McCue is one of the individuals who values the instructions.

There is a lot of good understanding, in my opinion. It’s extremely beneficial in your daily life. It teaches you everything you need to know about taxes, accounting, and other topics, according to McCue.

Six kids from Kubeny’s classes went to Madison last year to speak before the government about why these kinds of classes may be required for all high school students in the state. Some students feel strongly enough about it.

One of those kids was a rookie named Aiden Ostermann.

We were it, along with all the families and supporters who were advocating for it. They all undoubtedly concurred that they believe specific financing may be necessary, according to Ostermann. They really argued for a year, so our half-semester around is comparable to the rest of them.

Kubeny was pleased to witness the students’ testimony.

Eye of Wisconsin

I came in here immediately believing there was no way I was going to help this, but some of those legislators told us when those individuals were testifying, one person in particular, said talk. I have changed my mind after hearing your evidence around now, and I will now assist this act. Therefore, I mean, that gave me goosebumps, Kubeny said.

It was largely supported by both parties, according to Kubeny. Even so, passing the law wasn’t easy.

Although some politicians thought the course was crucial for students, they didn’t support it because it would add another burden to districts that currently struggle with cash and manpower.

Kubeny claims he recognizes the difficulty and wants lawmakers had included funding for the passage with the costs.

However, he claims that companies like Future Gen Personal Finance or Economics Wisconsin help institutions that teach financial literacy courses.

Therefore, according to Kubeny, all the citizens, including the bankers, credit union, and insurance companies, are ready to pitch in, offer assistance.

In the end, Kubeny believes that individuals need to understand the fundamentals of wealth management in order to help them make wise choices as they enter the world.

Now, things are different for children. Many of you didn’t have access to some of the other financial decisions that they make, for example, in Bitcoin or payday loan stores, there are so many more pitfalls and traps for someone who is not financially literate, Kubeny said. “When you were their age, the decisions they made financially starting out are going to be magnified a hundredfold.”

According to the new rules, Wisconsin high school students must earn at least 50% of their personal financial education credits in order to graduate.

The condition begins for the 2028 graduating course.