Proven Benefits of Early Financial Education

Recent studies underscore a critical link between financial literacy and enhanced financial stability, with research demonstrating substantial lifetime benefits for students who undertake personal finance courses in high school. According to a collaborative study by Tyton Partners and Next Gen Personal Finance, students can expect a potential financial gain of approximately $100,000 over their lifetime from just a one-semester course. This gain primarily stems from prudent financial practices such as avoiding high-interest debt and securing better borrowing rates due to improved credit scores.

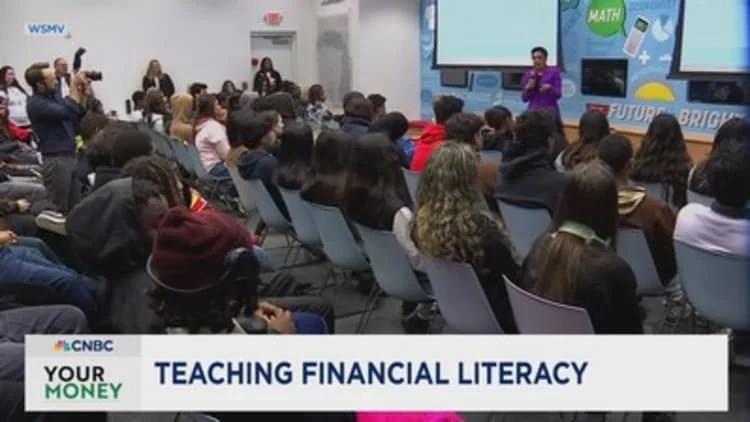

Transformative Impact on Students and Communities

Tim Ranzetta, co-founder and CEO of Next Gen Personal Finance, emphasizes the broader societal impact of financial education. He notes that the knowledge students acquire about managing finances effectively—such as understanding credit scores and avoiding costly loans—can have a ripple effect across families and communities, multiplying the economic benefits. Furthermore, educators like Kerri Herrild from De Pere High School in Wisconsin witness firsthand the “trickle-up effect” of financial education, where students pass on their knowledge to family members, reinforcing financial acumen within the community.

Increasing Momentum for Financial Literacy in Schools

The movement to incorporate personal finance education into the high school curriculum is gaining momentum across the United States. As of 2024, half of all states either require or are moving toward mandating a personal finance course for high school graduation. Moreover, legislative efforts are ongoing, with 35 additional bills being considered in 15 states to bolster personal finance education. This growing trend underscores a national recognition of the importance of equipping young people with financial skills essential for their future success, ensuring they are prepared not just for college but for life’s financial challenges.